Explore The Latest ACH & DEP TPG Products: Innovative Solutions For Your Business

What are ACH, DEP, and TPG products?

ACH, DEP, and TPG products are three types of electronic payment systems that allow businesses and individuals to transfer funds quickly and easily.

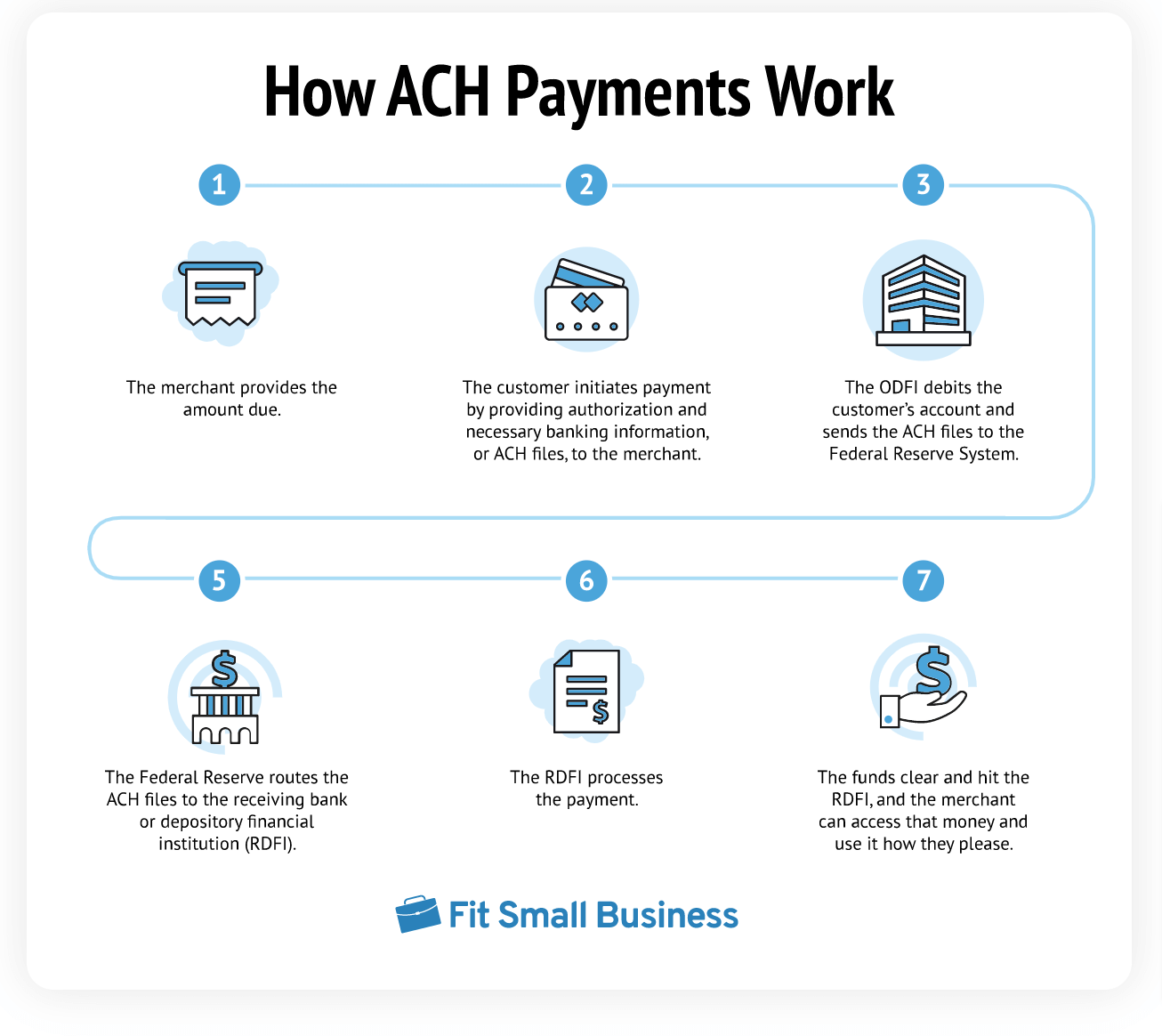

ACH (Automated Clearing House) is a network that allows banks and other financial institutions to transfer funds between accounts. ACH transfers are typically used for recurring payments, such as payroll, direct deposits, and bill payments.

DEP (Direct Entry Processing) is a service that allows businesses to send payments directly to their employees' bank accounts. DEP payments are typically used for payroll and other types of employee compensation.

TPG (Third-Party Processor) is a company that provides electronic payment processing services to businesses. TPGs can process ACH, DEP, and other types of electronic payments.

ACH, DEP, and TPG products are all important tools for businesses that need to make and receive payments electronically. These systems are fast, efficient, and secure, and they can help businesses save time and money.

- Jennifer Garner Ben Affleck Wedding

- Rhea Ripley Controversy

- Mexican Actors

- Connor Mccaffey

- May 17th Zodiac

ACH, DEP, and TPG Products

ACH, DEP, and TPG products are essential tools for businesses that need to make and receive payments electronically. These systems are fast, efficient, and secure, and they can help businesses save time and money.

- Automated

- Convenient

- Fast

- Secure

- Efficient

- Cost-effective

- Versatile

- Reliable

ACH, DEP, and TPG products can be used to process a variety of different types of payments, including payroll, direct deposits, bill payments, and vendor payments. These systems are also becoming increasingly popular for online and mobile payments.

Businesses that are looking to improve their payment processing should consider using ACH, DEP, or TPG products. These systems can help businesses save time and money, while also improving efficiency and security.

1. Automated

Automated ACH, DEP, and TPG products are essential for businesses that need to make and receive payments electronically. These systems automate the payment process, which can save businesses time and money. Additionally, automated ACH, DEP, and TPG products can help to improve accuracy and reduce errors.

For example, a business that uses an automated ACH system to process payroll can save time by not having to manually create and mail checks. Additionally, the automated system can help to ensure that employees are paid on time and that the correct amount is paid.

Automated ACH, DEP, and TPG products are also more secure than manual payment processes. This is because automated systems are less susceptible to fraud and errors. Additionally, automated systems can help to protect businesses from data breaches.

Overall, automated ACH, DEP, and TPG products are essential for businesses that need to make and receive payments electronically. These systems can save businesses time and money, while also improving accuracy, security, and efficiency.

2. Convenient

ACH, DEP, and TPG products are convenient for businesses and individuals because they allow for electronic payments, eliminating the need for paper checks and manual processing. This can save time and money, and it can also help to reduce errors.

- Online and mobile payments

ACH, DEP, and TPG products can be used to make payments online and through mobile devices. This is convenient for businesses that sell products or services online, and it is also convenient for individuals who want to make purchases or pay bills online.

- Recurring payments

ACH, DEP, and TPG products can be used to set up recurring payments, such as payroll, rent, and utility bills. This can save businesses time and money, and it can also help to ensure that payments are made on time.

- Direct deposits

ACH and DEP products can be used to make direct deposits into employees' bank accounts. This is convenient for businesses because it eliminates the need to write and mail checks, and it is also convenient for employees because they can have their paychecks deposited directly into their accounts.

- Vendor payments

ACH, DEP, and TPG products can be used to make payments to vendors. This is convenient for businesses because it eliminates the need to write and mail checks, and it is also convenient for vendors because they can receive payments electronically.

Overall, ACH, DEP, and TPG products are convenient for businesses and individuals because they allow for electronic payments, eliminating the need for paper checks and manual processing. This can save time and money, and it can also help to reduce errors.

3. Fast

ACH, DEP, and TPG products are fast, efficient, and secure. This is important for businesses that need to make and receive payments quickly and easily.

For example, a business that uses an ACH system to process payroll can save time by not having to manually create and mail checks. Additionally, the ACH system can help to ensure that employees are paid on time.

Another example is a business that uses a TPG product to process online payments. This can help the business to increase sales by making it easier for customers to purchase products or services.

Overall, the speed of ACH, DEP, and TPG products is a key benefit for businesses. These systems can help businesses save time and money, while also improving efficiency and customer satisfaction.

4. Secure

ACH, DEP, and TPG products are secure electronic payment systems that use encryption and other security measures to protect data and prevent fraud. This is important for businesses and individuals because it helps to protect their financial information and privacy.

For example, ACH payments are processed through a secure network that is monitored 24/7 for fraud. Additionally, ACH payments are protected by the ACH rules, which require banks to take steps to prevent and detect fraud.

Another example is TPG products. TPG products typically use encryption to protect data and prevent fraud. Additionally, TPG products are often PCI compliant, which means that they meet the Payment Card Industry Data Security Standard (PCI DSS). PCI DSS is a set of security standards that are designed to protect cardholder data.

Overall, ACH, DEP, and TPG products are secure electronic payment systems that can help businesses and individuals protect their financial information and privacy.

5. Efficient

ACH, DEP, and TPG products are efficient electronic payment systems that can save businesses and individuals time and money. This is because these systems automate the payment process, which eliminates the need for manual processing.

For example, a business that uses an ACH system to process payroll can save time by not having to manually create and mail checks. Additionally, the ACH system can help to ensure that employees are paid on time and that the correct amount is paid.

Another example is a business that uses a TPG product to process online payments. This can help the business to increase sales by making it easier for customers to purchase products or services.

Overall, the efficiency of ACH, DEP, and TPG products is a key benefit for businesses and individuals. These systems can help businesses and individuals save time and money, while also improving accuracy and security.

6. Cost-effective

ACH, DEP, and TPG products are cost-effective electronic payment systems that can save businesses and individuals money. This is because these systems eliminate the need for paper checks and manual processing, which can save businesses money on postage, printing, and labor costs.

- Reduced postage costs

Businesses that use ACH or DEP products to process payments can save money on postage costs. This is because electronic payments do not require postage, unlike paper checks.

- Reduced printing costs

Businesses that use ACH or DEP products to process payments can also save money on printing costs. This is because electronic payments do not require printing, unlike paper checks.

- Reduced labor costs

Businesses that use ACH or DEP products to process payments can save money on labor costs. This is because electronic payments can be processed automatically, unlike paper checks, which require manual processing.

- Reduced risk of errors

Electronic payments are less likely to contain errors than paper checks. This is because electronic payments are processed automatically, which reduces the risk of human error.

Overall, ACH, DEP, and TPG products are cost-effective electronic payment systems that can save businesses and individuals money. These systems eliminate the need for paper checks and manual processing, which can save businesses money on postage, printing, and labor costs.

7. Versatile

Versatile ACH, DEP, and TPG products offer a wide range of payment processing solutions for businesses of all sizes. These systems can be used to process a variety of different types of payments, including payroll, direct deposits, bill payments, and vendor payments. Additionally, ACH, DEP, and TPG products can be integrated with other business systems, such as accounting software and CRM systems.

- Multiple payment types

ACH, DEP, and TPG products can be used to process a variety of different types of payments, including payroll, direct deposits, bill payments, and vendor payments. This makes them a versatile solution for businesses that need to process a variety of different types of payments.

- Integration with other systems

ACH, DEP, and TPG products can be integrated with other business systems, such as accounting software and CRM systems. This allows businesses to automate their payment processing and improve efficiency.

- Scalability

ACH, DEP, and TPG products are scalable to meet the needs of businesses of all sizes. This means that businesses can start with a small system and grow as their business grows.

- Security

ACH, DEP, and TPG products are secure electronic payment systems that use encryption and other security measures to protect data and prevent fraud. This makes them a safe and reliable solution for businesses of all sizes.

Overall, the versatility of ACH, DEP, and TPG products makes them a valuable solution for businesses of all sizes. These systems can be used to process a variety of different types of payments, can be integrated with other business systems, and are scalable to meet the needs of businesses of all sizes. Additionally, ACH, DEP, and TPG products are secure and reliable, making them a safe and reliable solution for businesses of all sizes.

8. Reliable

Reliability is a critical component of ACH, DEP, and TPG products. Businesses and individuals rely on these systems to process payments quickly, securely, and accurately. Any disruption to these systems can have a significant impact on businesses and individuals.

There are a number of factors that contribute to the reliability of ACH, DEP, and TPG products. These include:

- Security: ACH, DEP, and TPG products use encryption and other security measures to protect data and prevent fraud. This helps to ensure that payments are processed securely and accurately.

- Redundancy: ACH, DEP, and TPG products are often designed with redundant systems to ensure that payments are processed even if one system fails. This helps to ensure that businesses and individuals can continue to make and receive payments even in the event of a disruption.

- Customer support: ACH, DEP, and TPG providers typically offer customer support to help businesses and individuals resolve any issues that they may encounter. This helps to ensure that businesses and individuals can get the help they need to process payments quickly and efficiently.

The reliability of ACH, DEP, and TPG products is essential for businesses and individuals. These systems allow businesses and individuals to make and receive payments quickly, securely, and accurately. Any disruption to these systems can have a significant impact on businesses and individuals, so it is important to choose a provider that offers reliable products and services.

FAQs on ACH, DEP, and TPG Products

This section provides answers to some of the most frequently asked questions about ACH, DEP, and TPG products.

Question 1: What are ACH, DEP, and TPG products?ACH, DEP, and TPG products are electronic payment systems that allow businesses and individuals to transfer funds quickly and easily. ACH (Automated Clearing House) is a network that allows banks and other financial institutions to transfer funds between accounts. DEP (Direct Entry Processing) is a service that allows businesses to send payments directly to their employees' bank accounts. TPG (Third-Party Processor) is a company that provides electronic payment processing services to businesses.

Question 2: What are the benefits of using ACH, DEP, and TPG products?ACH, DEP, and TPG products offer a number of benefits, including:

- Speed: ACH, DEP, and TPG products are faster than traditional paper-based payment methods.

- Security: ACH, DEP, and TPG products are secure and use encryption to protect data.

- Efficiency: ACH, DEP, and TPG products can help businesses save time and money by automating the payment process.

- Convenience: ACH, DEP, and TPG products offer a convenient way to make and receive payments.

To get started with ACH, DEP, and TPG products, you will need to contact a financial institution or payment processor. They will be able to help you set up an account and start processing payments.

Question 4: Are ACH, DEP, and TPG products safe?ACH, DEP, and TPG products are secure and use encryption to protect data. However, it is important to protect your account information and only use trusted payment processors.

Question 5: How can I learn more about ACH, DEP, and TPG products?There are a number of resources available to learn more about ACH, DEP, and TPG products. You can visit the websites of the National Automated Clearing House Association (NACHA), the Direct Deposit Association (DDA), and the Electronic Funds Transfer Association (EFTA). You can also contact a financial institution or payment processor for more information.

These are just a few of the most frequently asked questions about ACH, DEP, and TPG products. For more information, please visit the websites of the organizations listed above.

Transition to the next article section

Conclusion on ACH, DEP, and TPG Products

ACH, DEP, and TPG products are essential tools for businesses and individuals that need to make and receive payments electronically. These systems are fast, secure, efficient, and convenient, and they can help businesses save time and money. ACH, DEP, and TPG products are also versatile and scalable, making them a good solution for businesses of all sizes.

As the world increasingly moves towards electronic payments, ACH, DEP, and TPG products will continue to play an important role in the financial system. These systems are constantly being updated and improved, and they are expected to become even more efficient and convenient in the years to come.

- Vin Diesel Gal Gadot

- Andy Griffith The Darlings

- Zayne Emory

- Lucy Watson Age

- Toby Keiths Car Collection

ACH Payments What Are They and How Do They Work? (2022)

Why Did I Get a Deposit From TPG Products? Here's the Likely Reason

Santa Barbara TPG CPACharge