Discover If Adding Form 1098-T Boosts Tax Refund

Does adding a 1098-T increase my tax refund?

Yes, adding a 1098-T to your tax return can increase your tax refund. A 1098-T is a form that reports the amount of qualified tuition and related expenses that you paid for the year. This information is used to calculate the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), which are tax credits that can reduce the amount of taxes you owe. The AOTC is available for the first four years of post-secondary education, while the LLC is available for all years of post-secondary education. To claim the AOTC or LLC, you must meet certain eligibility requirements, such as being enrolled at least half-time in a qualified educational institution and having a valid Social Security number. If you meet the eligibility requirements, you can claim the AOTC or LLC by completing the IRS Form 8863, Education Credits. You can find more information about the AOTC and LLC on the IRS website.

The AOTC and LLC are valuable tax credits that can help you save money on your taxes. If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return to claim these credits.

Does adding a 1098-T increase refund?

Yes, adding a 1098-T to your tax return can increase your tax refund. Here are six key aspects to consider:

- Education expenses: The 1098-T reports qualified tuition and related expenses.

- Tax credits: The 1098-T can be used to claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC).

- Eligibility: To claim the AOTC or LLC, you must meet certain eligibility requirements.

- Form 8863: You must complete the IRS Form 8863 to claim the AOTC or LLC.

- Savings: The AOTC and LLC can help you save money on your taxes.

- Filing: Be sure to add a 1098-T to your tax return to claim the AOTC or LLC.

These six aspects are important to consider when determining whether adding a 1098-T to your tax return will increase your refund. If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return to claim the AOTC or LLC. These tax credits can help you save money on your taxes.

1. Education expenses

The 1098-T is a tax form that reports qualified tuition and related expenses paid for the year. This information is used to calculate the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), which are tax credits that can reduce the amount of taxes you owe. The AOTC is available for the first four years of post-secondary education, while the LLC is available for all years of post-secondary education.

To claim the AOTC or LLC, you must meet certain eligibility requirements, such as being enrolled at least half-time in a qualified educational institution and having a valid Social Security number. If you meet the eligibility requirements, you can claim the AOTC or LLC by completing the IRS Form 8863, Education Credits. You can find more information about the AOTC and LLC on the IRS website.

The AOTC and LLC are valuable tax credits that can help you save money on your taxes. If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return to claim these credits.

Here is an example of how adding a 1098-T to your tax return can increase your refund. Let's say you paid $10,000 in qualified tuition and related expenses during the year. You are eligible to claim the AOTC, which is worth up to $2,500. By adding a 1098-T to your tax return, you can reduce your tax liability by $2,500, which will increase your refund.

In conclusion, adding a 1098-T to your tax return can increase your refund by reducing your tax liability. If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return to claim the AOTC or LLC.

2. Tax credits

The 1098-T is a tax form that reports qualified tuition and related expenses paid for the year. This information is used to calculate the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), which are tax credits that can reduce the amount of taxes you owe. The AOTC is available for the first four years of post-secondary education, while the LLC is available for all years of post-secondary education.

To claim the AOTC or LLC, you must meet certain eligibility requirements, such as being enrolled at least half-time in a qualified educational institution and having a valid Social Security number. If you meet the eligibility requirements, you can claim the AOTC or LLC by completing the IRS Form 8863, Education Credits. You can find more information about the AOTC and LLC on the IRS website.

- AOTC: The AOTC is a tax credit of up to $2,500 per eligible student. The credit is available for the first four years of post-secondary education, and it is phased out for taxpayers with incomes above certain levels.

- LLC: The LLC is a tax credit of up to $2,000 per taxpayer. The credit is available for all years of post-secondary education, and it is phased out for taxpayers with incomes above certain levels.

The AOTC and LLC are valuable tax credits that can help you save money on your taxes. If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return to claim these credits.

In conclusion, the 1098-T is an important tax form that can be used to claim the AOTC or LLC. These tax credits can reduce the amount of taxes you owe, which can increase your refund. If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return to claim these credits.

3. Eligibility

To claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), you must meet certain eligibility requirements. These requirements include being enrolled at least half-time in a qualified educational institution and having a valid Social Security number. If you do not meet these requirements, you will not be able to claim the AOTC or LLC, and adding a 1098-T to your tax return will not increase your refund.

- Enrollment status: You must be enrolled at least half-time in a qualified educational institution to claim the AOTC or LLC. This means that you must be taking at least six credit hours per semester or quarter. If you are enrolled less than half-time, you will not be able to claim the AOTC or LLC.

- Academic progress: You must be making satisfactory academic progress towards a degree or other recognized educational credential to claim the AOTC or LLC. This means that you must be maintaining a certain GPA and completing your coursework on time. If you are not making satisfactory academic progress, you will not be able to claim the AOTC or LLC.

- Income limits: The AOTC and LLC are phased out for taxpayers with incomes above certain levels. This means that if your income is too high, you will not be able to claim the full amount of the AOTC or LLC. The income limits for the AOTC and LLC are adjusted each year for inflation.

If you meet the eligibility requirements for the AOTC or LLC, you can claim these credits by completing the IRS Form 8863, Education Credits. You can find more information about the AOTC and LLC on the IRS website.

In conclusion, meeting the eligibility requirements for the AOTC or LLC is essential to increasing your refund by adding a 1098-T to your tax return. If you do not meet these requirements, you will not be able to claim the AOTC or LLC, and adding a 1098-T to your tax return will not increase your refund.

4. Form 8863

The connection between Form 8863 and the question "does adding a 1098-T increase refund" is that Form 8863 is the IRS form used to claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC). The AOTC and LLC are tax credits that can reduce the amount of taxes you owe, which can increase your refund.

- Filing Form 8863

To claim the AOTC or LLC, you must complete and file Form 8863 with your tax return. On Form 8863, you will provide information about your qualified education expenses, such as tuition, fees, and books. You will also need to provide your Social Security number and information about your income. - Qualifying for the AOTC or LLC

To qualify for the AOTC or LLC, you must meet certain requirements, such as being enrolled at least half-time in a qualified educational institution and having a valid Social Security number. The AOTC is available for the first four years of post-secondary education, while the LLC is available for all years of post-secondary education. Both the AOTC and LLC are phased out for taxpayers with incomes above certain levels. - Calculating the AOTC or LLC

The amount of the AOTC or LLC that you can claim is based on your qualified education expenses and your income. The AOTC is worth up to $2,500 per eligible student, while the LLC is worth up to $2,000 per taxpayer. If your tax liability is less than the amount of the AOTC or LLC that you can claim, you may be eligible for a refund. - Adding a 1098-T to your tax return

If you paid qualified tuition and related expenses during the year, you will receive a 1098-T from your educational institution. The 1098-T reports the amount of qualified tuition and related expenses that you paid. You will need to attach the 1098-T to your tax return when you file Form 8863.

By completing and filing Form 8863, you can claim the AOTC or LLC, which can reduce your tax liability and increase your refund. If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return and complete Form 8863 to claim the AOTC or LLC.

5. Savings

In the context of "does adding a 1098-T increase refund?", the connection to "Savings: The AOTC and LLC can help you save money on your taxes" lies in the fact that the AOTC and LLC are tax credits that can reduce the amount of taxes you owe. By reducing your tax liability, the AOTC and LLC can increase your refund.

- Reduced tax liability

The AOTC and LLC are tax credits, which means that they directly reduce the amount of taxes you owe. The AOTC is worth up to $2,500 per eligible student, while the LLC is worth up to $2,000 per taxpayer. If you qualify for the AOTC or LLC, you can reduce your tax liability by up to these amounts. - Increased refund

If the AOTC or LLC reduces your tax liability to zero, you may be eligible for a refund. A refund is the amount of money that the IRS sends you when you have overpaid your taxes. If you add a 1098-T to your tax return and claim the AOTC or LLC, you may be eligible for a larger refund. - Example

Let's say you paid $10,000 in qualified tuition and related expenses during the year. You are eligible to claim the AOTC, which is worth up to $2,500. By claiming the AOTC, you can reduce your tax liability by $2,500. If your tax liability was $2,000 before claiming the AOTC, you would now have a tax liability of $0. This would make you eligible for a refund of $2,000.

In conclusion, the AOTC and LLC can help you save money on your taxes by reducing your tax liability. If you add a 1098-T to your tax return and claim the AOTC or LLC, you may be eligible for a larger refund.

6. Filing

To understand the connection between "Filing: Be sure to add a 1098-T to your tax return to claim the AOTC or LLC." and "does adding a 1098 t increase refund", it is important to first understand what the AOTC and LLC are, and how they relate to the 1098-T form.

- American Opportunity Tax Credit (AOTC)

The AOTC is a tax credit for qualified education expenses paid for the first four years of post-secondary education. The maximum credit amount is $2,500 per eligible student. - Lifetime Learning Credit (LLC)

The LLC is a tax credit for qualified education expenses paid for all years of post-secondary education. The maximum credit amount is $2,000 per taxpayer. - 1098-T Form

The 1098-T form is a tax form that reports qualified tuition and related expenses paid for the year. Educational institutions are required to send 1098-T forms to students who paid qualified expenses during the year.

To claim the AOTC or LLC, you must complete and file Form 8863, Education Credits, with your tax return. You will need to attach the 1098-T form to your tax return when you file Form 8863.

Adding a 1098-T to your tax return can increase your refund because the AOTC and LLC are tax credits. Tax credits directly reduce the amount of taxes you owe, which can result in a larger refund.

If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return and claim the AOTC or LLC. By doing so, you can reduce your tax liability and increase your refund.

FAQs

This section provides answers to frequently asked questions about the impact of adding a 1098-T form to your tax return on your refund.

Question 1: What is a 1098-T form?

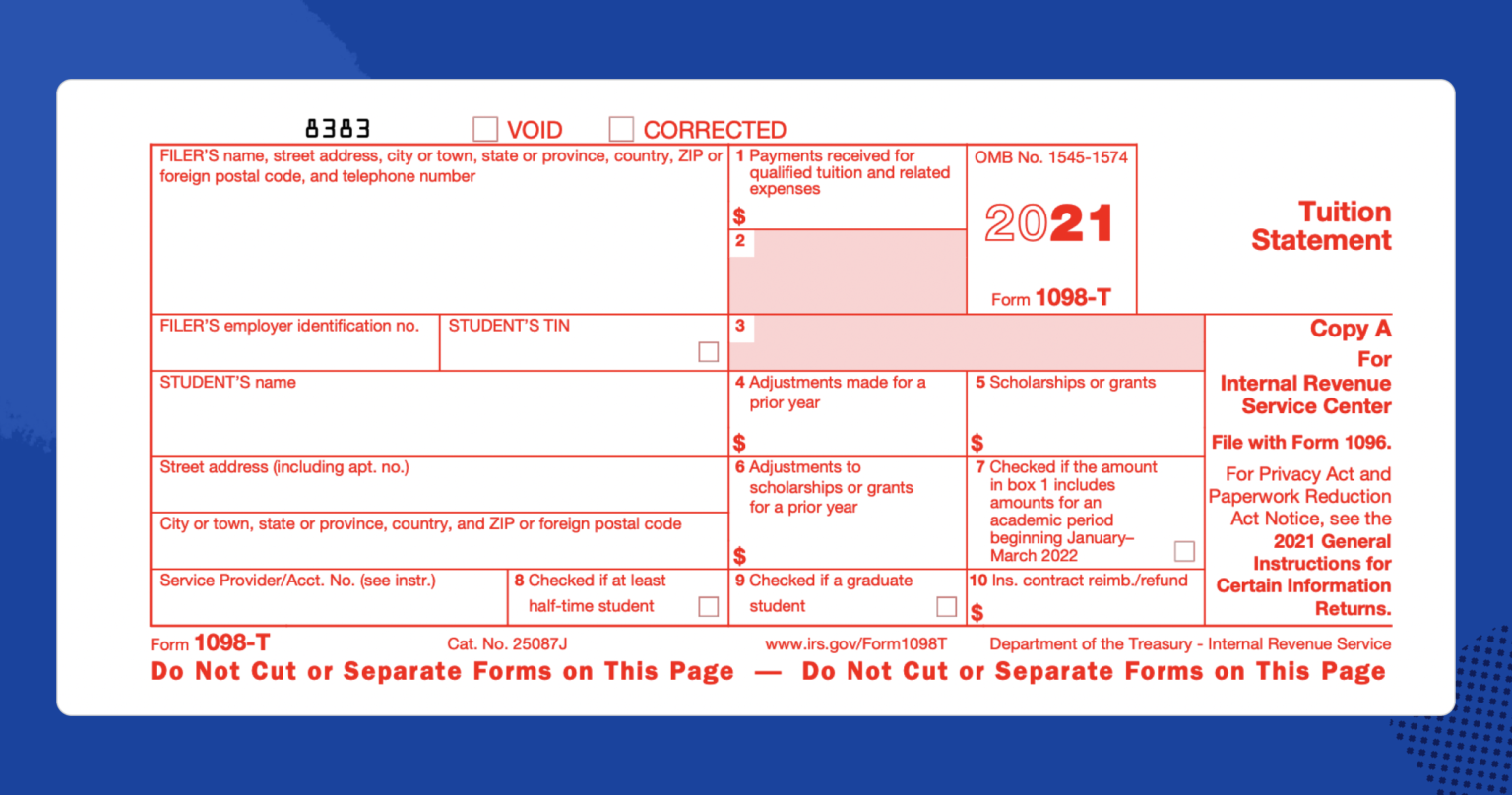

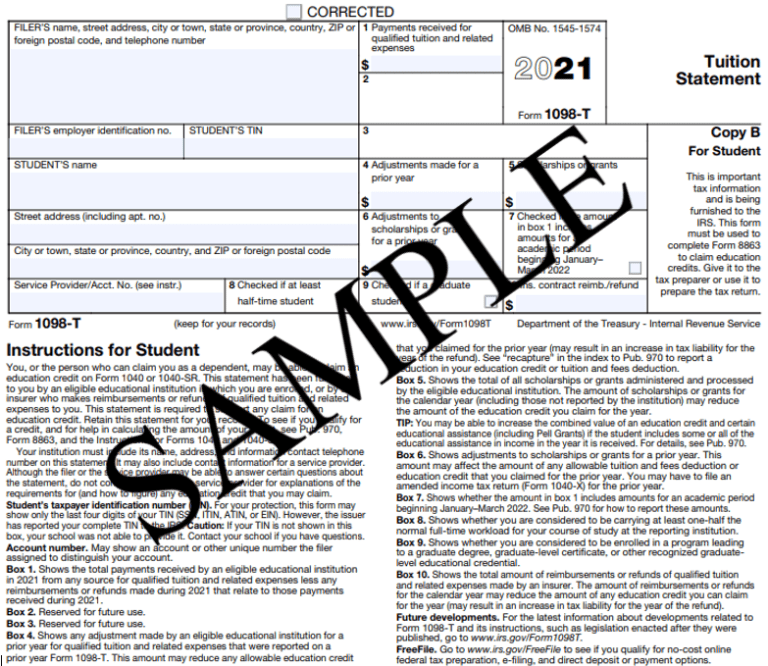

A 1098-T form is a tax form that reports qualified tuition and related expenses paid for the year. Educational institutions are required to send 1098-T forms to students who paid qualified expenses during the year.

Question 2: What is the American Opportunity Tax Credit (AOTC)?

The AOTC is a tax credit for qualified education expenses paid for the first four years of post-secondary education. The maximum credit amount is $2,500 per eligible student.

Question 3: What is the Lifetime Learning Credit (LLC)?

The LLC is a tax credit for qualified education expenses paid for all years of post-secondary education. The maximum credit amount is $2,000 per taxpayer.

Question 4: How can I claim the AOTC or LLC?

To claim the AOTC or LLC, you must complete and file Form 8863, Education Credits, with your tax return. You will need to attach the 1098-T form to your tax return when you file Form 8863.

Question 5: Will adding a 1098-T to my tax return increase my refund?

Yes, adding a 1098-T to your tax return can increase your refund because the AOTC and LLC are tax credits. Tax credits directly reduce the amount of taxes you owe, which can result in a larger refund.

Summary:

- A 1098-T form reports qualified tuition and related expenses paid for the year.

- The AOTC is a tax credit for qualified education expenses paid for the first four years of post-secondary education.

- The LLC is a tax credit for qualified education expenses paid for all years of post-secondary education.

- To claim the AOTC or LLC, you must complete and file Form 8863, Education Credits, with your tax return, and attach the 1098-T form to your tax return.

- Adding a 1098-T to your tax return can increase your refund because the AOTC and LLC are tax credits that directly reduce the amount of taxes you owe.

If you have any further questions about the AOTC, LLC, or 1098-T forms, please consult a tax professional.

Conclusion

In summary, adding a 1098-T form to your tax return can increase your refund by reducing your tax liability. The AOTC and LLC are valuable tax credits that can help you save money on your taxes. If you paid qualified tuition and related expenses during the year, be sure to add a 1098-T to your tax return to claim these credits.

If you have any questions about the AOTC, LLC, or 1098-T forms, please consult a tax professional.

1098T Form How to Complete and File Your Tuition Statement

:max_bytes(150000):strip_icc()/Form1098-30d7d922c32748bea2a293a28fbbe778.jpg)

1098 Form 2023 Printable Forms Free Online

IRS FORM 1098T Woodland Community College