Volkswagen Short Squeeze Chart: Uncovering The 2023 Trading Frenzy

What is a Volkswagen Short Squeeze Chart?

A Volkswagen short squeeze chart is a graphical representation of the price movement of Volkswagen stock during a short squeeze. A short squeeze occurs when a large number of short sellers are forced to buy back the stock they have sold short, causing the price of the stock to rise rapidly.

Short squeezes can be caused by a variety of factors, including positive news about the company, a change in market sentiment, or a large buy order. Short squeezes can be very profitable for investors who are able to identify them in advance.

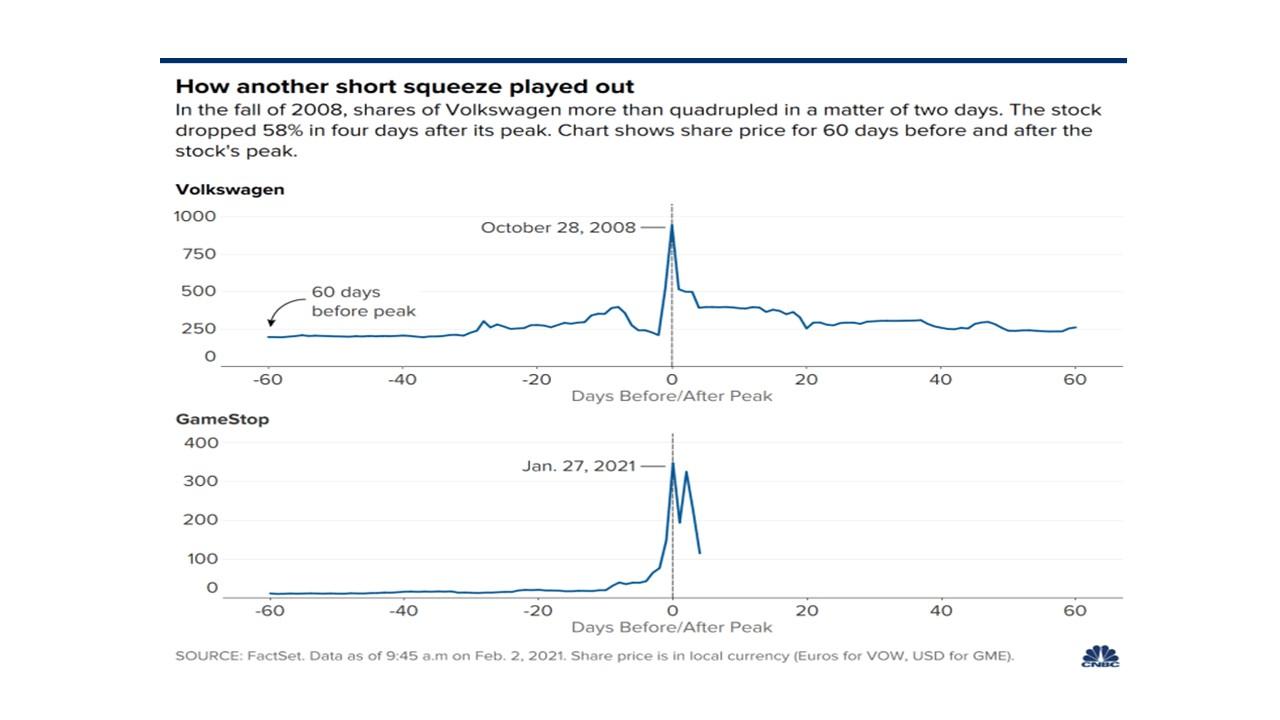

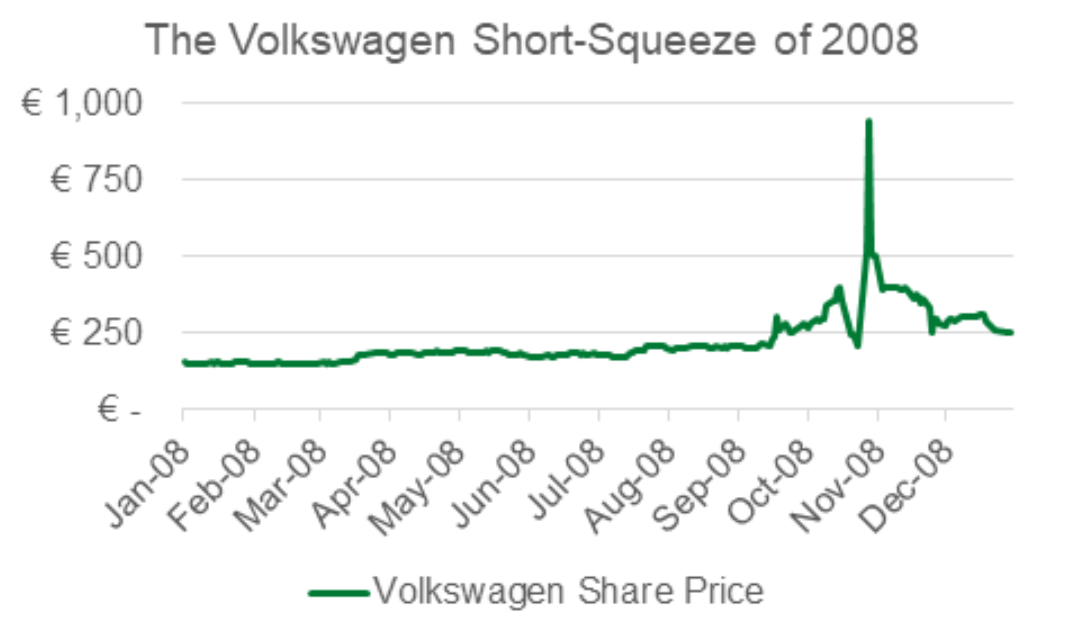

The Volkswagen short squeeze chart is one of the most famous examples of a short squeeze in history. In 2008, Porsche announced that it had acquired a large stake in Volkswagen. This news caused the price of Volkswagen stock to rise sharply, triggering a short squeeze. The short squeeze caused the price of Volkswagen stock to rise from 200 to over 1,000 in a matter of days.

The Volkswagen short squeeze chart is a reminder of the power of short squeezes. Short squeezes can be very profitable for investors who are able to identify them in advance. However, short squeezes can also be very risky, and investors should be aware of the risks before investing in a stock that is experiencing a short squeeze.Volkswagen Short Squeeze Chart

The Volkswagen short squeeze chart is a powerful tool that can help investors identify and profit from short squeezes. By understanding the key aspects of a Volkswagen short squeeze chart, investors can increase their chances of success.

- Price

- Volume

- Short interest

- Float

- Catalysts

- Technical indicators

- Risk

- Reward

By considering these key aspects, investors can develop a comprehensive understanding of a Volkswagen short squeeze chart. This understanding can help investors identify and profit from short squeezes, while also managing their risk.

- Elon Musk Father Net Worth

- Wade Wilson Crime Scene Photos

- On Firetom Selleck 2024 Photos

- 2kmovie

- Matthew Perry Brooke Mueller

For example, investors should look for stocks with a high short interest and a low float. These stocks are more likely to experience a short squeeze. Investors should also look for stocks that have positive catalysts, such as positive news or a change in market sentiment. These catalysts can trigger a short squeeze.

Finally, investors should be aware of the risks associated with short squeezes. Short squeezes can be very volatile, and investors can lose money if they are not careful. Investors should always do their own research before investing in a stock that is experiencing a short squeeze.

1. Price

Price is one of the most important factors to consider when analyzing a Volkswagen short squeeze chart. The price of a stock is determined by the balance of supply and demand. When there are more buyers than sellers, the price of the stock will rise. When there are more sellers than buyers, the price of the stock will fall.

In a short squeeze, the price of a stock rises rapidly because short sellers are forced to buy back the stock they have sold short. This buying pressure drives the price of the stock higher.

The price of a stock during a short squeeze can be very volatile. The stock price can rise very quickly, and it can also fall very quickly. Investors should be aware of the risks involved before investing in a stock that is experiencing a short squeeze.

Here are some examples of how price can be used to identify and profit from short squeezes:

- Identify stocks with a high short interest. Stocks with a high short interest are more likely to experience a short squeeze.

- Look for stocks that have a low float. Stocks with a low float are more likely to experience a short squeeze because there are fewer shares available to trade.

- Look for stocks that have positive catalysts. Positive catalysts, such as positive news or a change in market sentiment, can trigger a short squeeze.

- Use technical indicators to identify stocks that are overbought or oversold. Overbought stocks are more likely to experience a short squeeze, while oversold stocks are less likely to experience a short squeeze.

By considering the price of a stock, investors can increase their chances of identifying and profiting from short squeezes.

2. Volume

Volume is another important factor to consider when analyzing a Volkswagen short squeeze chart. Volume is the number of shares that are traded in a given period of time. Volume can be used to identify stocks that are experiencing a short squeeze.

In a short squeeze, volume will typically increase as the price of the stock rises. This is because short sellers are forced to buy back the stock they have sold short, which increases the demand for the stock and drives the price higher. The increase in volume can also help to identify stocks that are likely to experience a short squeeze.

For example, if a stock has a high short interest and a low float, and the volume is increasing, this could be a sign that a short squeeze is about to occur. Investors can use this information to identify and profit from short squeezes.

Here are some examples of how volume can be used to identify and profit from short squeezes:

- Identify stocks with a high short interest and a low float. Stocks with a high short interest and a low float are more likely to experience a short squeeze.

- Look for stocks that have increasing volume. Increasing volume can be a sign that a short squeeze is about to occur.

- Use technical indicators to identify stocks that are overbought or oversold. Overbought stocks are more likely to experience a short squeeze, while oversold stocks are less likely to experience a short squeeze.

By considering the volume of a stock, investors can increase their chances of identifying and profiting from short squeezes.

3. Short interest

Short interest is the number of shares of a stock that have been sold short but not yet covered. Short interest is an important factor to consider when analyzing a Volkswagen short squeeze chart because it can help to identify stocks that are likely to experience a short squeeze.

- High short interest

Stocks with a high short interest are more likely to experience a short squeeze. This is because short sellers are more likely to be forced to buy back the stock they have sold short if the price of the stock rises.

Low floatStocks with a low float are more likely to experience a short squeeze. This is because there are fewer shares available to trade, which makes it more difficult for short sellers to cover their positions.

Positive catalystsPositive catalysts, such as positive news or a change in market sentiment, can trigger a short squeeze. This is because positive catalysts can cause the price of the stock to rise, which forces short sellers to buy back the stock they have sold short.

Technical indicatorsTechnical indicators can be used to identify stocks that are overbought or oversold. Overbought stocks are more likely to experience a short squeeze, while oversold stocks are less likely to experience a short squeeze.

By considering short interest, investors can increase their chances of identifying and profiting from short squeezes.

4. Float

Float is the number of shares of a stock that are available to trade in the public market. Float is an important factor to consider when analyzing a Volkswagen short squeeze chart because it can help to identify stocks that are likely to experience a short squeeze.

Stocks with a low float are more likely to experience a short squeeze because there are fewer shares available to trade. This makes it more difficult for short sellers to cover their positions, which can lead to a short squeeze.

For example, Volkswagen had a low float of 100 million shares in 2008. This made it difficult for short sellers to cover their positions when the price of Volkswagen stock began to rise. The resulting short squeeze caused the price of Volkswagen stock to rise from 200 to over 1,000 in a matter of days.

Investors can use float to identify stocks that are likely to experience a short squeeze. By understanding the relationship between float and short squeezes, investors can increase their chances of profiting from this trading strategy.

5. Catalysts

Catalysts are events or announcements that can trigger a short squeeze. Short squeezes occur when a large number of short sellers are forced to buy back the stock they have sold short, causing the price of the stock to rise rapidly. Catalysts can be positive or negative, but they all have the potential to trigger a short squeeze.

Positive catalysts include:

- Positive earnings reports

- New product announcements

- Positive analyst reports

- Upgrades by credit rating agencies

- Mergers and acquisitions

Negative catalysts include:

- Negative earnings reports

- Product recalls

- Negative analyst reports

- Downgrades by credit rating agencies

- Legal problems

Catalysts are an important part of Volkswagen short squeeze chart analysis. By understanding the different types of catalysts and how they can affect the price of a stock, investors can increase their chances of profiting from short squeezes.

For example, in 2008, Porsche announced that it had acquired a large stake in Volkswagen. This news was a positive catalyst for Volkswagen's stock price, and it triggered a short squeeze that caused the price of Volkswagen stock to rise from 200 to over 1,000 in a matter of days.

Investors can use catalysts to identify stocks that are likely to experience a short squeeze. By understanding the relationship between catalysts and short squeezes, investors can increase their chances of profiting from this trading strategy.

6. Technical indicators

Technical indicators are a valuable tool for identifying and profiting from short squeezes. Short squeezes occur when a large number of short sellers are forced to buy back the stock they have sold short, causing the price of the stock to rise rapidly. Technical indicators can help investors to identify stocks that are likely to experience a short squeeze, and they can also be used to time the entry and exit points of a short squeeze trade.

One of the most important technical indicators to consider when analyzing a Volkswagen short squeeze chart is the short interest ratio. The short interest ratio is the number of shares that have been sold short divided by the total number of shares outstanding. A high short interest ratio indicates that there is a large number of short sellers who are vulnerable to a short squeeze.

Another important technical indicator to consider is the relative strength index (RSI). The RSI is a momentum indicator that measures the speed and magnitude of price changes. A high RSI indicates that the stock is overbought and may be due for a correction. Conversely, a low RSI indicates that the stock is oversold and may be due for a rally.

Technical indicators can be a valuable tool for identifying and profiting from short squeezes. By understanding how to use technical indicators, investors can increase their chances of success when trading short squeezes.

Here is an example of how technical indicators can be used to identify a Volkswagen short squeeze:

In 2008, the short interest ratio for Volkswagen was over 100%. This indicated that there was a large number of short sellers who were vulnerable to a short squeeze. The RSI was also over 70, indicating that the stock was overbought and may be due for a correction.

These technical indicators suggested that Volkswagen was a good candidate for a short squeeze. Investors who had identified this opportunity were able to profit handsomely when the short squeeze occurred.

Technical indicators are a valuable tool for identifying and profiting from short squeezes. By understanding how to use technical indicators, investors can increase their chances of success when trading short squeezes.

7. Risk

Understanding the risks associated with short squeezes is critical for investors. Short squeezes can be very profitable, but they can also be very risky. Investors should be aware of the risks before investing in a stock that is experiencing a short squeeze.

- Price volatility

The price of a stock during a short squeeze can be very volatile. The stock price can rise very quickly, and it can also fall very quickly. Investors should be prepared for the possibility of large swings in the stock price.

- Loss of capital

Investors can lose money if they invest in a stock that is experiencing a short squeeze. If the short squeeze ends, the price of the stock can fall quickly. Investors should be aware of the possibility of losing money before investing in a stock that is experiencing a short squeeze.

- Margin calls

Investors who are trading on margin may be subject to margin calls if the price of the stock falls. A margin call is a demand from the broker to deposit additional funds into the account. If the investor cannot meet the margin call, the broker may sell the investor's shares.

- Short squeeze failure

Not all short squeezes are successful. Sometimes, the short sellers are able to cover their positions without causing a significant increase in the price of the stock. In these cases, investors who have purchased the stock in anticipation of a short squeeze may lose money.

Investors should carefully consider the risks before investing in a stock that is experiencing a short squeeze. Short squeezes can be very profitable, but they can also be very risky.

8. Reward

In the context of a Volkswagen short squeeze chart, reward refers to the potential profit that can be made by correctly identifying and trading a short squeeze. Short squeezes can be very profitable for investors who are able to identify them in advance.

- High returns

Short squeezes can generate very high returns for investors. In some cases, investors have been able to double or even triple their money in a matter of days.

- Short time frame

Short squeezes can occur very quickly. In some cases, a short squeeze can last for only a few days or even hours. This means that investors can make a lot of money in a short period of time.

- Low risk

Short squeezes are relatively low risk compared to other trading strategies. This is because the investor is betting on the price of the stock to rise, which is a relatively safe bet.

- Tax advantages

Short squeezes can also provide tax advantages. If the investor holds the stock for more than one year, the profits from the short squeeze will be taxed at the long-term capital gains rate, which is lower than the short-term capital gains rate.

Overall, the reward for correctly identifying and trading a Volkswagen short squeeze can be very high. However, it is important to remember that short squeezes are also risky. Investors should always do their own research before investing in a stock that is experiencing a short squeeze.

FAQs on Volkswagen Short Squeeze Chart

This section provides answers to frequently asked questions about Volkswagen short squeeze charts. These charts are a valuable tool for investors who want to identify and profit from short squeezes.

Question 1: What is a Volkswagen short squeeze chart?

A Volkswagen short squeeze chart is a graphical representation of the price movement of Volkswagen stock during a short squeeze. A short squeeze occurs when a large number of short sellers are forced to buy back the stock they have sold short, causing the price of the stock to rise rapidly.

Question 2: How can I use a Volkswagen short squeeze chart to identify short squeezes?

There are a number of factors to consider when using a Volkswagen short squeeze chart to identify short squeezes. These factors include the price of the stock, the volume of trading, the short interest, the float, and the presence of catalysts.

Question 3: What are the risks of trading Volkswagen short squeezes?

There are a number of risks associated with trading Volkswagen short squeezes. These risks include the price volatility of the stock, the possibility of a margin call, and the risk of a short squeeze failure.

Question 4: What are the rewards of trading Volkswagen short squeezes?

The rewards of trading Volkswagen short squeezes can be very high. In some cases, investors have been able to double or even triple their money in a matter of days. However, it is important to remember that short squeezes are also risky.

Question 5: How can I learn more about Volkswagen short squeeze charts?

There are a number of resources available to investors who want to learn more about Volkswagen short squeeze charts. These resources include books, articles, and websites.

Summary: Volkswagen short squeeze charts can be a valuable tool for investors who want to identify and profit from short squeezes. However, it is important to remember that short squeezes are also risky. Investors should always do their own research before investing in a stock that is experiencing a short squeeze.

Transition to Next Section: Now that you have learned more about Volkswagen short squeeze charts, you may be interested in learning more about other trading strategies.

Conclusion

Volkswagen short squeeze charts are a valuable tool for investors who want to identify and profit from short squeezes. However, it is important to remember that short squeezes are also risky. Investors should always do their own research before investing in a stock that is experiencing a short squeeze.

Short squeezes can be a very profitable trading strategy, but they are also risky. Investors should carefully consider the risks and rewards before investing in a stock that is experiencing a short squeeze.

Volkswagen Short Squeeze in 2008, Market Phenomena Explained

Volkswagen Short Squeeze Chart Days Ayat Hendricks

GameStop Short Squeeze 5 Things To Know As We Reach The Endgame