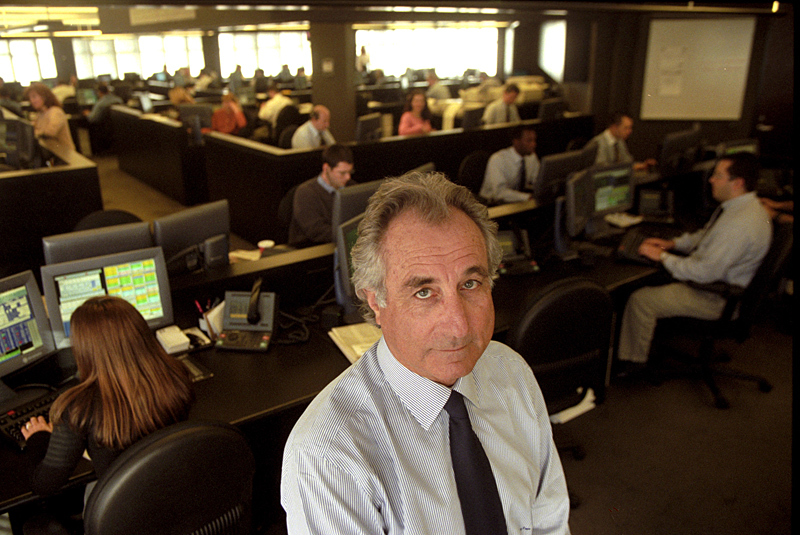

The Inside Story Of Bernie Madoff's Notorious Office

"Bernie Madoff office", the name that became synonymous with one of the largest financial frauds in history.

Bernie Madoff's office was located at 1118 Avenue of the Americas in New York City. It was from this office that Madoff orchestrated a massive Ponzi scheme that defrauded investors of an estimated $65 billion.

Madoff's scheme was based on the promise of high returns with little risk. He lured investors in with promises of steady returns of 10-12% per year, regardless of market conditions. To maintain the illusion of legitimacy, Madoff created fictitious trading records and sent out regular account statements to his clients.

For years, Madoff's scheme went undetected. However, in 2008, as the financial crisis began to take hold, investors began to redeem their investments. Madoff was unable to meet these redemption requests, and his scheme finally collapsed.

Madoff was arrested in December 2008 and pleaded guilty to 11 federal felonies. He was sentenced to 150 years in prison, where he died in 2021.

The Bernie Madoff office is a reminder of the dangers of greed and the importance of due diligence when investing.

- Bane Character In Batman Movie

- Mexican Actors

- Micah Stephen Williams

- Johnny Depp Upcoming Movies 2024

- Young Martin Short

Bernie Madoff Office

Bernie Madoff's office was the hub of one of the largest financial frauds in history. Here are seven key aspects of the Bernie Madoff office:

- Location: 1118 Avenue of the Americas, New York City

- Employees: Approximately 20

- Services: Investment advisory services

- Clients: High-net-worth individuals, banks, and charities

- Scheme: Ponzi scheme

- Duration: Over 20 years

- Losses: An estimated $65 billion

Madoff's office was a well-respected financial institution on the surface. However, behind closed doors, it was a hive of illegal activity. Madoff used his office to orchestrate a massive Ponzi scheme that defrauded investors of billions of dollars. Madoff's scheme eventually collapsed in 2008, and he was arrested and sentenced to 150 years in prison.

The Bernie Madoff office is a reminder of the dangers of greed and the importance of due diligence when investing. It is also a reminder that even the most respected financial institutions can be involved in fraud.

1. Location

1118 Avenue of the Americas, New York City was the address of Bernie Madoff's investment firm, Bernard L. Madoff Investment Securities LLC. The firm occupied the entire 17th floor of the Lipstick Building, a prominent skyscraper in Midtown Manhattan.

- Proximity to financial institutions: The Lipstick Building is located in the heart of New York City's financial district, which is home to many of the world's largest banks and investment firms. This proximity gave Madoff easy access to potential investors and clients.

- Prestige: The Lipstick Building is a well-known and prestigious address. This gave Madoff's firm an air of legitimacy and helped to attract investors.

- Secrecy: The 17th floor of the Lipstick Building is not easily accessible to the public. This gave Madoff and his employees a degree of privacy and secrecy, which they used to conceal their fraudulent activities.

- Symbolism: The Lipstick Building is a phallic symbol, which has been interpreted as a reflection of Madoff's own grandiose and narcissistic personality.

The location of Bernie Madoff's office was an important factor in the success of his Ponzi scheme. The prestigious address and proximity to financial institutions gave Madoff an air of legitimacy, while the privacy and secrecy of the 17th floor allowed him to conceal his fraudulent activities.

2. Employees

The Bernie Madoff office was staffed by approximately 20 employees. These employees played a vital role in the success of Madoff's Ponzi scheme.

- Client management: Madoff's employees were responsible for managing relationships with clients. They would often meet with clients in person or over the phone to discuss their investment goals and to encourage them to invest with Madoff.

- Trade processing: Madoff's employees were also responsible for processing trades. They would enter trade orders into the firm's computer system and then send them to the appropriate broker-dealers for execution.

- Account maintenance: Madoff's employees were responsible for maintaining client accounts. They would update account balances, send out account statements, and handle any other account-related inquiries.

- Secrecy: Madoff's employees were sworn to secrecy. They were not allowed to discuss the firm's investment strategies with anyone outside of the office.

The employees of the Bernie Madoff office played a vital role in the success of his Ponzi scheme. They were responsible for managing client relationships, processing trades, maintaining accounts, and keeping the scheme a secret.

3. Services

Bernie Madoff's office offered investment advisory services to its clients. This was the primary means by which Madoff attracted investors and perpetrated his Ponzi scheme.

- Financial planning: Madoff's office offered financial planning services to its clients. This included helping clients to develop investment goals, create a diversified portfolio, and manage their risk tolerance.

- Investment management: Madoff's office offered investment management services to its clients. This included making investment decisions on behalf of clients, managing their portfolios, and providing regular account statements.

- Retirement planning: Madoff's office offered retirement planning services to its clients. This included helping clients to save for retirement, choose the right investment vehicles, and plan for their future financial needs.

- Estate planning: Madoff's office offered estate planning services to its clients. This included helping clients to create wills and trusts, and plan for the distribution of their assets after their death.

The investment advisory services offered by Bernie Madoff's office were a key component of his Ponzi scheme. Madoff used these services to attract investors and to create the illusion of a legitimate investment firm. In reality, Madoff was using his clients' money to pay off earlier investors, and he was not actually investing their money as he claimed.

4. Clients

Bernie Madoff's office catered to a wide range of clients, including high-net-worth individuals, banks, and charities. These clients were attracted to Madoff's office by the promise of high returns with little risk. Madoff used his clients' money to pay off earlier investors, creating the illusion of a legitimate investment firm.

High-net-worth individuals are individuals with a net worth of $1 million or more. These individuals often have complex financial needs and are looking for investment opportunities that can help them grow their wealth. Madoff targeted high-net-worth individuals by offering them personalized investment advice and promising them high returns with little risk.

Banks are financial institutions that accept deposits from customers and make loans. Banks are often looking for investment opportunities that can provide them with a steady stream of income. Madoff targeted banks by offering them high-yield investment products that were supposedly backed by a portfolio of blue-chip stocks.

Charities are non-profit organizations that rely on donations to fund their activities. Charities are often looking for investment opportunities that can provide them with a steady stream of income to support their programs. Madoff targeted charities by offering them high-yield investment products that were supposedly backed by a portfolio of blue-chip stocks.

The connection between "Clients: High-net-worth individuals, banks, and charities" and "bernie madoff office" is significant because it highlights the wide range of investors who were defrauded by Madoff's Ponzi scheme. Madoff's scheme was not limited to a particular type of investor, and he was able to attract investors from all walks of life.

5. Scheme

Bernie Madoff's office was the hub of a massive Ponzi scheme, which is a fraudulent investment scheme that pays returns to investors from the capital contributed by new investors, rather than from genuine investment profits.

- How it works: In a Ponzi scheme, the fraudster promises investors high returns with little or no risk. The fraudster then uses the money from new investors to pay off earlier investors, creating the illusion of a legitimate investment.

- Madoff's scheme: Madoff's Ponzi scheme was one of the largest in history. He promised investors returns of 10-12% per year, regardless of market conditions. Madoff used the money from new investors to pay off earlier investors, and he used some of the money to fund his lavish lifestyle.

- The collapse: Madoff's scheme eventually collapsed in 2008, when he was unable to attract new investors to fund the payments to earlier investors. Madoff was arrested and sentenced to 150 years in prison.

The Bernie Madoff office is a reminder of the dangers of Ponzi schemes. These schemes are often very attractive to investors, as they promise high returns with little or no risk. However, Ponzi schemes are always unsustainable, and they will eventually collapse.

6. Duration

The Bernie Madoff office operated for over 20 years, from the early 1990s until Madoff's arrest in 2008. This long duration is significant for several reasons:

- Time to build trust: The long duration of Madoff's scheme gave him time to build trust with his investors. Many of his investors were with him for over a decade, and they came to trust him implicitly. This trust made it easier for Madoff to continue his scheme, as investors were less likely to question his activities.

- Time to grow the scheme: The long duration of Madoff's scheme also gave him time to grow the scheme to a massive size. By the time of his arrest, Madoff's scheme had defrauded investors of an estimated $65 billion.

- Time to avoid detection: The long duration of Madoff's scheme also gave him time to avoid detection. Madoff was able to use his knowledge of the financial industry to hide his fraudulent activities from regulators and auditors.

The long duration of the Bernie Madoff office is a reminder of the dangers of Ponzi schemes. These schemes can operate for many years, and they can grow to a massive size before they are finally detected.

7. Losses

The Bernie Madoff office was the hub of a massive Ponzi scheme that defrauded investors of an estimated $65 billion. This staggering loss is one of the largest in history, and it has had a significant impact on the financial industry and the lives of the victims.

The losses incurred by Madoff's victims are a direct result of his fraudulent activities. Madoff promised investors high returns with little or no risk, but he was actually using their money to pay off earlier investors. This unsustainable scheme eventually collapsed, and Madoff's investors lost everything.

The losses from the Bernie Madoff office are a reminder of the dangers of Ponzi schemes. These schemes are often very attractive to investors, as they promise high returns with little or no risk. However, Ponzi schemes are always unsustainable, and they will eventually collapse.

The Bernie Madoff office is also a reminder of the importance of due diligence when investing. Investors should always research potential investments carefully and be wary of any investment that promises high returns with little or no risk.

FAQs on Bernie Madoff Office

The Bernie Madoff office was the center of one of the largest financial frauds in history. Here are some frequently asked questions about the Bernie Madoff office:

Question 1: What was the Bernie Madoff office?

Answer: The Bernie Madoff office was an investment firm that was run by Bernie Madoff. The firm offered investment advisory services to high-net-worth individuals, banks, and charities. Madoff used the money from new investors to pay off earlier investors, creating the illusion of a legitimate investment.

Question 2: How long did the Bernie Madoff office operate?

Answer: The Bernie Madoff office operated for over 20 years, from the early 1990s until Madoff's arrest in 2008.

Question 3: How much money did investors lose in the Bernie Madoff scheme?

Answer: Investors lost an estimated $65 billion in the Bernie Madoff scheme.

Question 4: How was the Bernie Madoff scheme discovered?

Answer: The Bernie Madoff scheme was discovered when Madoff was unable to meet redemption requests from investors during the financial crisis of 2008.

Question 5: What happened to Bernie Madoff?

Answer: Bernie Madoff was arrested in 2008 and sentenced to 150 years in prison. He died in prison in 2021.

Summary: The Bernie Madoff office was the hub of a massive Ponzi scheme that defrauded investors of an estimated $65 billion. The scheme operated for over 20 years before it was finally discovered in 2008. Madoff was sentenced to 150 years in prison for his crimes.

Transition: To learn more about the Bernie Madoff office and the Ponzi scheme that it perpetrated, please see the following resources:

- SEC Charges Bernie Madoff

- Madoff Sentenced to 150 Years in Prison

- Frontline: The Madoff Affair

Bernie Madoff Office

The Bernie Madoff office was the hub of one of the largest financial frauds in history. Madoff's Ponzi scheme defrauded investors of an estimated $65 billion, and its collapse had a devastating impact on the financial industry and the lives of the victims.

The Bernie Madoff office is a cautionary tale about the dangers of greed and the importance of due diligence when investing. It is a reminder that even the most trusted financial institutions can be involved in fraud, and that investors should always be wary of any investment that promises high returns with little or no risk.

- Lainey Wilson Feet

- Vin Diesel Gal Gadot

- Brad Pitt Brothers And Sisters

- Christopher Lloyd Spouse

- Mark Paul Gosselaar Mom And Dad

Bernard Madoff, ce psychopathe Les Echos

For rent Madoff's old office The San Diego UnionTribune

Chasing Madoff (2010)