Locate Bank Branch Numbers Swiftly On Your Checks

What is a branch number on a check?

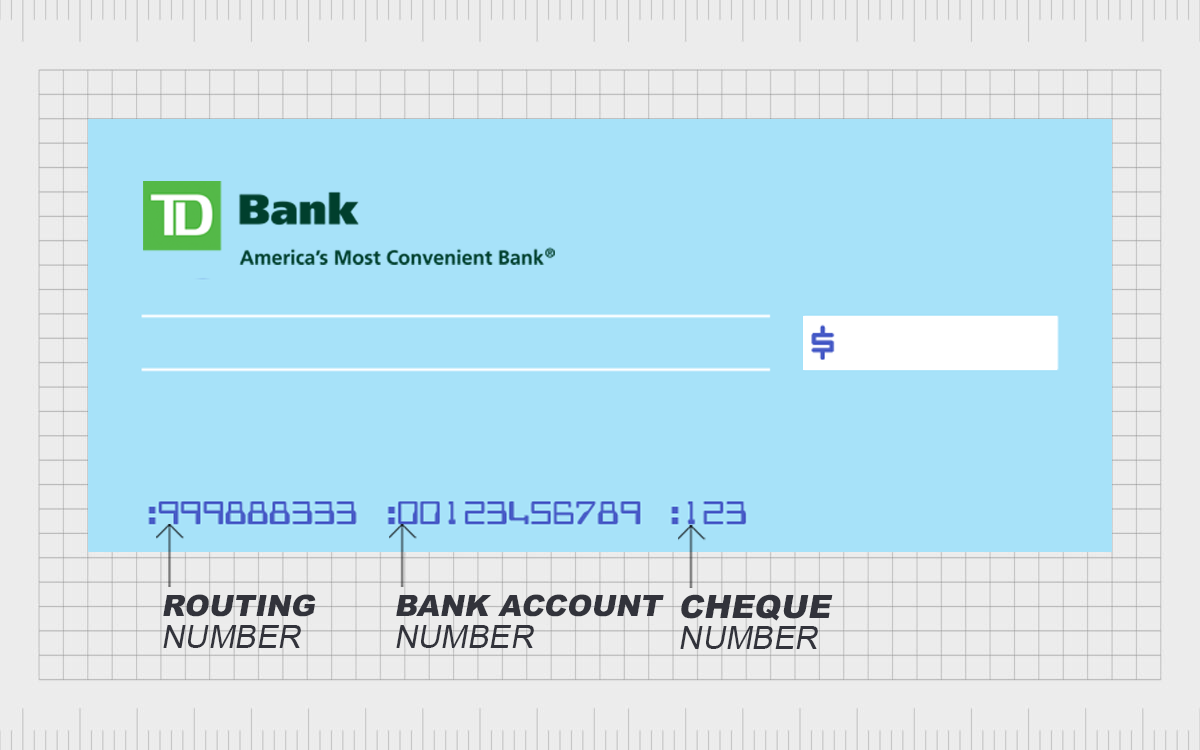

A branch number on a check is a unique identifier for the specific branch of a bank where the account holder maintains their account. It is typically printed on the bottom of the check, along with the bank's routing number and the account number.

The branch number is used by the bank to process checks and ensure that the funds are transferred to the correct account. It is also used by other financial institutions to identify the branch where the account is held.

- When Is Lil Boosies Birthday

- Andy Griffith The Darlings

- Jason Beghe

- Who Is Tyrus Wife

- Rory Feek New Wife

Branch numbers are important because they help to ensure that checks are processed correctly and that funds are transferred to the correct account. They also help to prevent fraud by making it more difficult for counterfeit checks to be cashed.

Here are some of the benefits of using branch numbers on checks:

- They help to ensure that checks are processed correctly.

- They help to prevent fraud.

- They can help to identify the branch where the account is held.

Branch numbers are an important part of the check processing system. They help to ensure that checks are processed correctly and that funds are transferred to the correct account. They also help to prevent fraud.

- Mark Paul Gosselaar Mom And Dad

- Billy Ray Cyrus Billy Ray Cyrus

- Eileen Abad

- Young Martin Short

- Wedding Jesse Metcalfe Wife

Branch Number on Check

Branch numbers on checks are essential for ensuring the smooth processing and security of financial transactions. Here are six key aspects to consider:

- Identification: Uniquely identifies the bank branch where the account is held.

- Routing: Directs the check to the correct financial institution for processing.

- Security: Helps prevent fraud by making it difficult to counterfeit checks.

- Verification: Allows banks to verify the authenticity of checks.

- Efficiency: Streamlines the check processing system, ensuring timely fund transfers.

- Compliance: Meets regulatory requirements for check processing.

These aspects are interconnected and play a crucial role in the overall functionality of the check processing system. For instance, the branch number aids in identifying the correct branch for account verification, which enhances security and reduces the risk of fraudulent activities. Furthermore, it facilitates efficient routing, ensuring that checks reach the intended destination promptly.

1. Identification

The branch number on a check serves as a vital identification tool for the bank branch associated with the account holder. This unique identifier plays a crucial role in the check processing system by directing the check to the correct branch for further processing and verification.

The identification aspect of the branch number is critical for several reasons. Firstly, it enables the bank to verify the authenticity of the check and the account holder's identity. By matching the branch number with the account information on file, banks can identify potential fraudulent activities or discrepancies.

Moreover, the branch number facilitates efficient check processing by streamlining the routing process. When a check is deposited or cashed, the branch number helps direct the check to the appropriate branch for account verification and fund transfer. This efficient routing ensures timely processing and reduces delays or errors in the transaction.

In summary, the identification aspect of the branch number on a check is essential for maintaining the integrity and efficiency of the check processing system. It provides a secure and reliable method for banks to verify account information and route checks to the correct branch, minimizing the risk of fraud and ensuring timely fund transfers.

2. Routing

The routing number, often printed alongside the branch number on a check, plays a crucial role in the check processing system. It serves as a unique identifier for the financial institution where the account holder's bank account is held. When a check is deposited or cashed, the routing number directs the check to the correct financial institution for further processing.

The connection between the routing number and the branch number is essential for ensuring the smooth and efficient flow of financial transactions. The branch number identifies the specific branch where the account is held, while the routing number identifies the financial institution. Together, these two pieces of information provide a clear and precise destination for the check, ensuring that it reaches the correct bank for processing.

In practical terms, the routing number ensures that the check is processed by the correct financial institution. This is particularly important in cases where the bank has multiple branches. Without the routing number, the check could be inadvertently sent to the wrong branch, leading to delays or errors in processing. The accurate and efficient routing of checks is critical for businesses and individuals alike, as it ensures timely access to funds and minimizes disruptions in financial transactions.

In summary, the routing number, in conjunction with the branch number, plays a vital role in directing checks to the correct financial institution for processing. This efficient and secure system ensures the smooth flow of financial transactions, minimizing delays and errors, and providing convenience and reliability to businesses and individuals.

3. Security

The branch number on a check plays a crucial role in preventing fraud and safeguarding financial transactions. Counterfeit checks pose a significant threat to individuals and businesses alike, and the branch number serves as a critical defense mechanism against this type of fraud.

When a check is presented for payment, the branch number is used to verify the authenticity of the check and the account holder's identity. Banks maintain records of branch numbers and associated account information, allowing them to cross-check the validity of the presented check. If the branch number does not match the records on file, it raises a red flag, indicating a potential fraud attempt.

Moreover, the branch number makes it more difficult for fraudsters to create counterfeit checks. The unique combination of the branch number, account number, and routing number creates a complex and secure system that is not easily replicated. Counterfeiters would need to obtain all three pieces of information accurately to create a convincing fake check, which is a challenging task.

In summary, the branch number on a check is a vital security feature that helps prevent fraud and protects individuals and businesses from financial losses. Its role in verifying the authenticity of checks and deterring counterfeiters contributes to the overall security and reliability of the check processing system.

4. Verification

The branch number on a check plays a crucial role in enabling banks to verify the authenticity of checks and prevent fraud. It serves as a key identifier that helps banks cross-check the validity of a check against their records.

- Matching Account Information:

When a check is presented for payment, the branch number is used to retrieve the account holder's information from the bank's database. The bank then compares the branch number on the check with the branch number associated with the account. If the numbers match, it helps verify that the check is legitimate and drawn from a valid account.

- Identifying Counterfeit Checks:

Counterfeit checks often contain inaccurate or manipulated information, including the branch number. By comparing the branch number on the check with their records, banks can identify potential counterfeit checks. If the branch number does not correspond with any existing branch or account, it raises a red flag, indicating a fraudulent attempt.

- Preventing Check Washing:

Check washing is a type of fraud where the ink from a genuine check is removed and replaced with new payee and amount information. The branch number can help detect check washing. When a washed check is presented, the branch number may not match the original account information, alerting the bank to a potential fraud.

- Enhancing Security Measures:

The branch number adds an extra layer of security to the check processing system. It makes it more difficult for fraudsters to create convincing counterfeit checks or alter genuine checks. The unique combination of the branch number, account number, and routing number creates a complex system that deters fraud attempts.

In conclusion, the branch number on a check is a crucial element in the verification process conducted by banks. It helps prevent fraud, ensures the authenticity of checks, and safeguards the integrity of the check processing system.

5. Efficiency

The branch number on a check plays a vital role in streamlining the check processing system and ensuring timely fund transfers. It functions as a key identifier that facilitates efficient check processing and accurate routing, contributing to the overall efficiency of the financial transaction system.

- Accurate and Swift Routing:

The branch number helps direct the check to the correct branch and financial institution for processing. This accurate and swift routing ensures that checks are processed and funds are transferred in a timely manner, minimizing delays and disruptions in financial transactions.

- Reduced Errors and Fraud:

The branch number helps prevent errors and fraud in check processing. By verifying the legitimacy of the check and the account holder's identity, the branch number reduces the risk of fraudulent activities and ensures the secure transfer of funds.

- Automated Processing:

In modern banking systems, the branch number enables automated check processing. This automation streamlines the process, reducing manual intervention and human errors, which contributes to faster and more efficient fund transfers.

- Improved Customer Experience:

The efficient processing of checks ensures timely availability of funds for businesses and individuals. This improves customer experience by reducing delays and uncertainties associated with check clearances, leading to greater satisfaction and trust in the financial system.

In conclusion, the branch number on a check is a critical element that contributes to the efficiency of the check processing system. It facilitates accurate and swift routing, reduces errors and fraud, enables automated processing, and ultimately enhances the customer experience by ensuring timely fund transfers.

6. Compliance

The branch number on a check plays a crucial role in ensuring compliance with regulatory requirements for check processing. Regulatory bodies establish guidelines and standards to prevent fraud, protect consumer rights, and maintain the integrity of the financial system. The branch number contributes to meeting these requirements in several ways:

Accurate and Traceable Transactions: The branch number helps banks accurately process and trace check transactions. By identifying the specific branch associated with the account, banks can verify the legitimacy of the check and the account holder's identity. This reduces the risk of fraudulent activities and ensures that funds are transferred to the correct recipient.

Anti-Money Laundering and Fraud Prevention: Regulatory requirements mandate banks to implement measures to prevent money laundering and other financial crimes. The branch number provides an additional layer of security by enabling banks to monitor and track large or suspicious check transactions. By identifying the branch where the check was issued, banks can investigate potential irregularities and report suspicious activities to the appropriate authorities.

Consumer Protection: Compliance with regulatory requirements also involves protecting consumer rights. The branch number helps banks identify and resolve errors or disputes related to check processing. By providing a clear record of the branch where the check was processed, consumers can easily contact the relevant branch for assistance or to report any discrepancies.

In summary, the branch number on a check is an essential element in meeting regulatory requirements for check processing. It enhances the accuracy and traceability of transactions, aids in preventing fraud and money laundering, and supports consumer protection measures. By adhering to these requirements, banks maintain the integrity of the check processing system and foster trust in the financial system.

FAQs on Branch Number on Check

The branch number on a check is a crucial element in the check processing system, ensuring the accuracy, security, and compliance of financial transactions. Here are some frequently asked questions (FAQs) to clarify common concerns and misconceptions:

Question 1: What is the purpose of a branch number on a check?The branch number uniquely identifies the specific branch of the bank where the account holder maintains their account. It plays a vital role in directing the check to the correct branch for processing and verifying the authenticity of the check and the account holder's identity.

Question 2: Where can I find the branch number on a check?The branch number is typically printed on the bottom of the check, along with the bank's routing number and the account number. It is usually a 4- or 5-digit number.

Question 3: Why is it important to provide the branch number when depositing or cashing a check?Providing the correct branch number is essential for efficient check processing. It helps ensure that the check is routed to the correct branch for account verification and fund transfer. This reduces delays and errors in the transaction.

Question 4: What happens if I provide an incorrect branch number?Providing an incorrect branch number can delay the check processing and may result in errors. The check may be sent to the wrong branch, leading to difficulties in verifying the account information and transferring funds.

Question 5: Can I change the branch number associated with my account?Yes, you can usually change the branch number associated with your account by contacting your bank. However, it is important to note that changing the branch number may require updating your records with other institutions or individuals who have your check information.

In summary, the branch number on a check serves as a critical identifier in the check processing system. It ensures the accurate and secure transfer of funds, helps prevent fraud, and meets regulatory requirements. By understanding the purpose and importance of the branch number, individuals can contribute to the smooth and efficient processing of checks.

Transition to the next article section...

Conclusion

The branch number on a check plays a pivotal role in the check processing system, ensuring the accuracy, security, and compliance of financial transactions. It uniquely identifies the branch where the account is held, facilitating the efficient routing and verification of checks.

The branch number contributes to the prevention of fraud by making it difficult to counterfeit checks and by aiding banks in verifying the authenticity of checks and account holders. It also enhances the efficiency of the check processing system, streamlining the flow of funds and reducing errors. Furthermore, the branch number helps banks comply with regulatory requirements related to check processing, including anti-money laundering measures and consumer protection.

In conclusion, the branch number on a check is an essential element in the financial system, supporting the secure and reliable processing of checks. Understanding the purpose and importance of the branch number empowers individuals and businesses to participate effectively in the check-based payment system.

- Jennifer Hudson Husband 2024

- Which Members Of Little Big Town Are Married

- Jason Momoa Johnny Depp

- Chris Norman And Suzi Quatro

- Did Tom Holland Propose

Home Bank Routing Numbers and Transit (Branch) Numbers

How to Find Updated TD Bank Routing Number (2024)

How to find your Bank Routing Number in Canada [2024] Protect Your Wealth