Compare Your Options: Brokerage Holdings Vs. Brokerage Cash At Robinhood

Brokerage Holdings vs Brokerage Cash

Understanding the difference between brokerage holdings and brokerage cash is essential for making informed investment decisions with Robinhood.

- Definition: Brokerage holdings are the stocks, bonds, and other investments that you own through your Robinhood account, while brokerage cash is the uninvested money in your account.

- Liquidity: Brokerage holdings can be bought, sold, or traded at any time, while brokerage cash can be withdrawn from your account at any time.

- Return potential: Brokerage holdings have the potential to earn a return over time, while brokerage cash does not.

- Risk: Brokerage holdings are subject to market risk, while brokerage cash is not.

- Taxes: Brokerage holdings may be subject to capital gains taxes when sold, while brokerage cash is not.

- Investment goals: Brokerage holdings are suitable for long-term investment goals, while brokerage cash is suitable for short-term goals or emergencies.

- Diversification: Brokerage holdings can be diversified across different asset classes to reduce risk, while brokerage cash is not diversified.

- Fees: Robinhood charges no fees for trading stocks or ETFs, but it does charge fees for certain other types of investments.

Ultimately, the best way to use brokerage holdings and brokerage cash depends on your individual investment goals and risk tolerance. If you are looking to grow your wealth over time, you may want to invest your brokerage cash in a diversified portfolio of stocks and bonds. However, if you need to access your money quickly, you may want to keep it in brokerage cash.

1. Definition: Brokerage holdings are the stocks, bonds, and other investments that you own through your Robinhood account, while brokerage cash is the uninvested money in your account.

This definition is essential to understanding the concept of "brokerage holdings vs brokerage cash robinhood". Brokerage holdings represent the assets that you have invested in through your Robinhood account, while brokerage cash represents the uninvested funds that you have available to invest or withdraw.

- What Height Is Chappell Roan

- Who Is Angela Lansbury Married To

- Home Alone Bird Lady

- Dolph Lundgren Height

- Coach K

- Components of Brokerage Holdings

Brokerage holdings can include a variety of different investments, such as stocks, bonds, ETFs, and options. Each type of investment has its own unique risk and return profile, so it is important to understand the differences before investing.

- Components of Brokerage Cash

Brokerage cash is simply the uninvested funds that you have in your Robinhood account. This cash can be used to buy new investments, or it can be withdrawn from your account at any time.

- Management of Brokerage Holdings and Brokerage Cash

It is important to carefully manage your brokerage holdings and brokerage cash in order to meet your investment goals. This includes regularly reviewing your portfolio and making adjustments as needed.

- Taxes on Brokerage Holdings and Brokerage Cash

Brokerage holdings and brokerage cash may be subject to different tax implications. It is important to understand the tax laws that apply to your investments before making any decisions.

By understanding the definition of brokerage holdings and brokerage cash, you can make more informed investment decisions and achieve your financial goals.

2. Liquidity: Brokerage holdings can be bought, sold, or traded at any time, while brokerage cash can be withdrawn from your account at any time.

The liquidity of brokerage holdings and brokerage cash is a key factor to consider when investing with Robinhood. Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price.

Brokerage holdings, such as stocks and ETFs, are generally more liquid than brokerage cash. This means that you can buy or sell brokerage holdings quickly and easily without having to worry about a large impact on the price. Brokerage cash, on the other hand, is highly liquid and can be withdrawn from your account at any time without any impact on its value.

The liquidity of brokerage holdings and brokerage cash is important for several reasons. First, it allows you to quickly and easily adjust your investment portfolio as needed. For example, if you need to raise cash quickly, you can sell some of your brokerage holdings without having to worry about a large impact on the price. Second, the liquidity of brokerage holdings and brokerage cash allows you to take advantage of market opportunities. For example, if you see a stock that you believe is undervalued, you can quickly and easily buy it without having to worry about a large impact on the price.

Of course, the liquidity of brokerage holdings and brokerage cash also comes with some risks. For example, if the market suddenly turns against you, you may not be able to sell your brokerage holdings quickly enough to avoid losses. Additionally, the liquidity of brokerage cash can tempt you to make impulsive investment decisions.

Overall, the liquidity of brokerage holdings and brokerage cash is a key factor to consider when investing with Robinhood. By understanding the liquidity of different assets, you can make more informed investment decisions and achieve your financial goals.

3. Return potential: Brokerage holdings have the potential to earn a return over time, while brokerage cash does not.

The return potential of brokerage holdings and brokerage cash is a key factor to consider when investing with Robinhood. Return potential refers to the potential for an investment to increase in value over time.

Brokerage holdings, such as stocks and ETFs, have the potential to earn a return over time through capital appreciation and dividends. Capital appreciation is the increase in the price of an investment, while dividends are payments made by companies to their shareholders. Brokerage cash, on the other hand, does not have the potential to earn a return over time.

The return potential of brokerage holdings is important for several reasons. First, it can help you grow your wealth over time. If you invest in brokerage holdings that have a high return potential, you can potentially earn a significant amount of money over the long term. Second, the return potential of brokerage holdings can help you reach your financial goals. For example, if you are saving for retirement, you may want to invest in brokerage holdings that have a high return potential in order to reach your retirement goals faster.

Of course, the return potential of brokerage holdings also comes with some risks. For example, the value of brokerage holdings can fluctuate over time, and you may lose money if you sell your holdings at a loss. Additionally, some brokerage holdings may not pay dividends, and you may not earn any return on your investment.

Overall, the return potential of brokerage holdings is a key factor to consider when investing with Robinhood. By understanding the return potential of different assets, you can make more informed investment decisions and achieve your financial goals.

4. Risk: Brokerage holdings are subject to market risk, while brokerage cash is not.

Market risk is the risk that the value of an investment will fluctuate due to changes in the market. Brokerage holdings, such as stocks and ETFs, are subject to market risk, which means that their value can go up or down over time. Brokerage cash, on the other hand, is not subject to market risk, which means that its value will not fluctuate due to changes in the market.

The difference in risk between brokerage holdings and brokerage cash is an important factor to consider when investing with Robinhood. If you are not comfortable with the risk of losing money, you may want to keep your money in brokerage cash. However, if you are willing to take on more risk in order to potentially earn a higher return, you may want to invest in brokerage holdings.

Here are some examples of how market risk can affect brokerage holdings:

- If the stock market crashes, the value of your brokerage holdings may go down.

- If the interest rates rise, the value of your bonds may go down.

- If the value of the US dollar falls, the value of your foreign investments may go down.

It is important to understand the risks involved in investing before you invest any money. You should only invest money that you can afford to lose.

By understanding the connection between risk and brokerage holdings vs brokerage cash robinhood, you can make more informed investment decisions and achieve your financial goals.

5. Taxes: Brokerage holdings may be subject to capital gains taxes when sold, while brokerage cash is not.

When investing with Robinhood, it is important to understand the tax implications of your investment decisions. One of the key differences between brokerage holdings and brokerage cash is the way they are taxed.

Brokerage holdings, such as stocks and ETFs, are subject to capital gains taxes when they are sold. Capital gains taxes are taxes on the profit that you make when you sell an investment. The amount of capital gains tax that you owe depends on how long you held the investment and your tax bracket.

Brokerage cash, on the other hand, is not subject to capital gains taxes. This means that you can withdraw brokerage cash from your Robinhood account at any time without having to pay taxes on it.

The difference in taxation between brokerage holdings and brokerage cash is an important factor to consider when making investment decisions. If you are not sure how the taxes will affect your investment, it is important to speak with a tax advisor.

Here are some examples of how taxes can affect brokerage holdings and brokerage cash:

- If you sell a stock that you have held for less than one year, you will be taxed on the profit at your ordinary income tax rate.

- If you sell a stock that you have held for more than one year, you will be taxed on the profit at the capital gains tax rate, which is lower than the ordinary income tax rate.

- If you withdraw brokerage cash from your Robinhood account, you will not have to pay any taxes on it.

By understanding the tax implications of brokerage holdings and brokerage cash, you can make more informed investment decisions and achieve your financial goals.

6. Investment goals: Brokerage holdings are suitable for long-term investment goals, while brokerage cash is suitable for short-term goals or emergencies.

The distinction between brokerage holdings and brokerage cash becomes even more crucial when considering investment goals. Brokerage holdings, such as stocks and ETFs, are generally more appropriate for long-term investment goals. This is because they have the potential to generate higher returns over time, although they may also come with greater risk.

- Long-Term Investment Goals

Brokerage holdings can be a valuable tool for achieving long-term investment goals, such as retirement planning or saving for a down payment on a house. By investing in a diversified portfolio of stocks and ETFs, you can potentially earn a higher return than you would from a savings account or money market account. However, it is important to remember that the value of your brokerage holdings can fluctuate over time, so you should be prepared to ride out market ups and downs.

- Short-Term Goals or Emergencies

Brokerage cash is a better choice for short-term goals or emergencies, such as saving for a vacation or a car repair. This is because brokerage cash is highly liquid, meaning that you can access your funds quickly and easily. Additionally, brokerage cash is not subject to market risk, so you do not have to worry about losing money due to market fluctuations.

Ultimately, the best way to use brokerage holdings and brokerage cash depends on your individual investment goals and risk tolerance. If you are looking to grow your wealth over time, brokerage holdings may be a good option. However, if you need to access your money quickly or are not comfortable with taking on risk, brokerage cash may be a better choice.

7. Diversification: Brokerage holdings can be diversified across different asset classes to reduce risk, while brokerage cash is not diversified.

Diversification is an important investment strategy that can help to reduce risk. By diversifying your investments across different asset classes, you can reduce the impact of any one asset class on your overall portfolio. For example, if you invest in a portfolio of stocks, bonds, and real estate, you are less likely to lose all of your money if one asset class performs poorly.

- Benefits of Diversification

There are several benefits to diversifying your brokerage holdings. First, diversification can help to reduce risk. By investing in a variety of asset classes, you can reduce the impact of any one asset class on your overall portfolio. Second, diversification can help to improve returns. By investing in a variety of asset classes, you can increase your chances of earning a positive return over time. Third, diversification can help to reduce stress. By investing in a variety of asset classes, you can reduce your anxiety about the performance of your investments.

- Risks of Diversification

While diversification can be a beneficial investment strategy, there are also some risks to consider. First, diversification can be expensive. Investing in a variety of asset classes can require you to pay multiple fees. Second, diversification can be complex. Investing in a variety of asset classes can be complex and time-consuming. Third, diversification may not always be effective. Diversification can help to reduce risk, but it cannot eliminate risk.

Overall, diversification is an important investment strategy that can help to reduce risk, improve returns, and reduce stress. However, there are also some risks to consider before diversifying your investments.

8. Fees: Robinhood charges no fees for trading stocks or ETFs, but it does charge fees for certain other types of investments.

The fee structure of Robinhood is an important consideration when choosing a brokerage account. Robinhood charges no fees for trading stocks or ETFs, but it does charge fees for certain other types of investments, such as options and mutual funds. This fee structure can have a significant impact on the profitability of your trading activity.

For example, if you are a frequent trader of options, the fees charged by Robinhood can quickly eat into your profits. However, if you are primarily a stock or ETF trader, the fee structure of Robinhood is very competitive.

It is important to understand the fee structure of Robinhood before you open an account. This will help you to make informed decisions about which types of investments to trade and how often to trade.

Here is a summary of the key points to consider about the fee structure of Robinhood:

- Robinhood charges no fees for trading stocks or ETFs.

- Robinhood charges fees for certain other types of investments, such as options and mutual funds.

- The fee structure of Robinhood can have a significant impact on the profitability of your trading activity.

- It is important to understand the fee structure of Robinhood before you open an account.

FAQs on Brokerage Holdings vs Brokerage Cash on Robinhood

This section provides answers to frequently asked questions (FAQs) about brokerage holdings and brokerage cash on Robinhood, offering valuable insights for investors.

Question 1: What is the key difference between brokerage holdings and brokerage cash?

Answer: Brokerage holdings represent the stocks, bonds, and other investments owned through a Robinhood account, while brokerage cash refers to the uninvested funds available in the account.

Question 2: Which is more liquid: brokerage holdings or brokerage cash?

Answer: Brokerage cash is highly liquid and can be withdrawn at any time, while brokerage holdings, such as stocks and ETFs, may have varying levels of liquidity depending on market conditions.

Question 3: Do brokerage holdings and brokerage cash have different tax implications?

Answer: Yes, brokerage holdings may be subject to capital gains taxes when sold, while brokerage cash is not taxed until withdrawn from the account.

Question 4: Which is more suitable for long-term goals: brokerage holdings or brokerage cash?

Answer: Brokerage holdings, such as stocks and ETFs, have the potential for higher returns over time and are generally more appropriate for long-term investment goals.

Question 5: How do I manage both brokerage holdings and brokerage cash effectively?

Answer: Effective management involves regularly reviewing your portfolio, diversifying investments across different asset classes, and understanding the fees and tax implications associated with both brokerage holdings and brokerage cash.

Understanding these key differences and nuances is crucial for making informed investment decisions on Robinhood and achieving your financial goals.

Transition to the next article section: For further insights into investment strategies and managing your Robinhood account, explore the following sections.

Conclusion

Understanding the distinction between brokerage holdings and brokerage cash is essential for effective investing on Robinhood. Brokerage holdings represent the stocks, bonds, and other investments owned through the platform, while brokerage cash refers to the uninvested funds available.

Brokerage holdings offer the potential for growth through capital appreciation and dividends, but they are subject to market fluctuations and capital gains taxes. Brokerage cash provides liquidity and stability, but it does not generate returns on its own. The choice between the two depends on investment goals, risk tolerance, and tax implications.

By carefully managing both brokerage holdings and brokerage cash, investors can optimize their portfolios, mitigate risks, and achieve their financial objectives. Remember to regularly review your investments, diversify across asset classes, and consider the fees and taxes associated with each type of investment.

Brokerage VS Cash Management Account

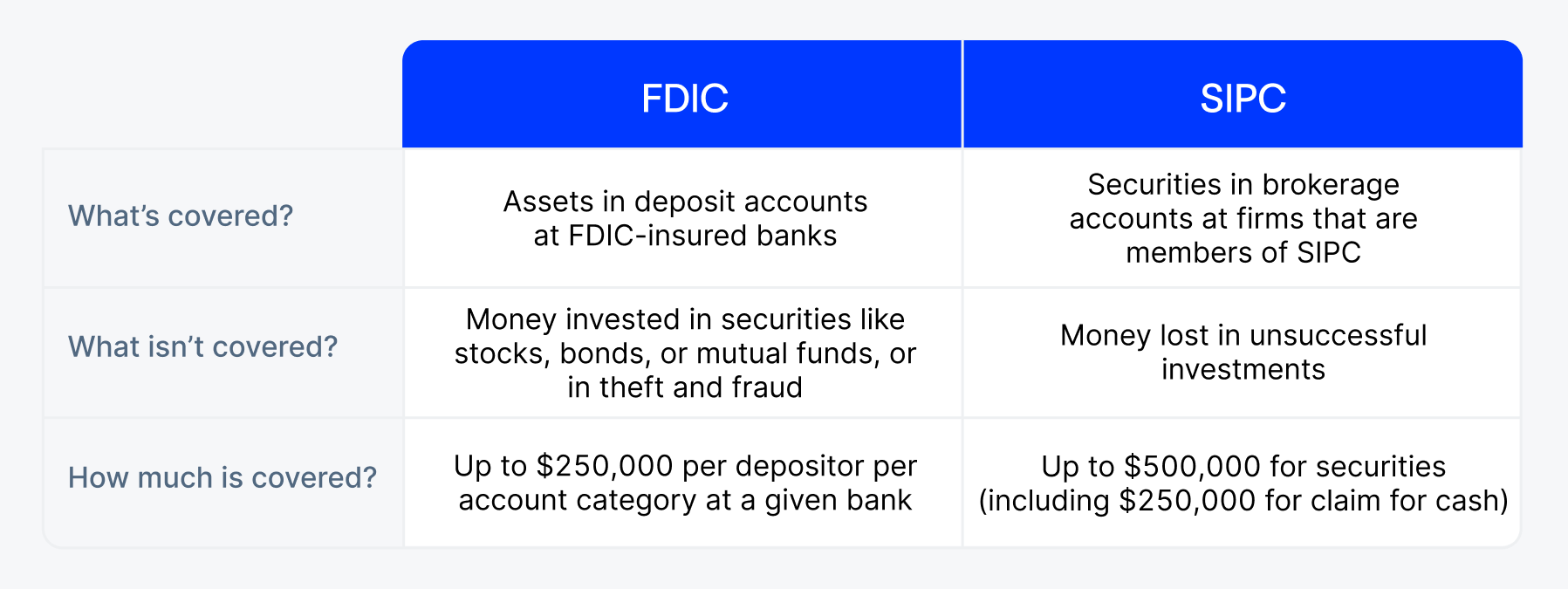

FDIC vs SIPC insurance Is your money safe?

how to make money on Robinhood robinhood brokerage cash sweep program