Robinhood W-2 Release Date: When To Expect Your Tax Form

When is the Robinhood W-2 release date?

The Robinhood W-2 release date is typically in late January or early February. This is the date by which employers are required to provide employees with their W-2 forms, which are used to report wages and taxes for the previous year.

It's important to note that the Robinhood W-2 release date may vary from year to year. For the most up-to-date information, it's best to check with Robinhood directly.

Robinhood W-2 Release Date

The Robinhood W-2 release date is an important date for taxpayers who use Robinhood to invest. Here are seven key aspects of the Robinhood W-2 release date:

- Timing: The Robinhood W-2 release date is typically in late January or early February.

- Importance: The W-2 form is used to report wages and taxes for the previous year.

- Accuracy: It is important to review your W-2 form carefully to ensure that it is accurate.

- Filing: You will need your W-2 form to file your taxes.

- Deadline: The deadline to file your taxes is April 15th.

- Extensions: You can request an extension to file your taxes if you need more time.

- Penalties: There may be penalties if you fail to file your taxes on time or if you file an inaccurate return.

These are just a few of the key aspects of the Robinhood W-2 release date. It is important to be aware of these aspects so that you can file your taxes accurately and on time.

1. Timing

The Robinhood W-2 release date is important for taxpayers who use Robinhood to invest. The W-2 form is used to report wages and taxes for the previous year. By knowing the Robinhood W-2 release date, taxpayers can ensure that they have the information they need to file their taxes accurately and on time.

- Importance of timely filing: Filing taxes on time is important to avoid penalties and interest charges. The Robinhood W-2 release date provides taxpayers with ample time to gather the necessary information and file their taxes before the April 15th deadline.

- Accuracy: The W-2 form is a critical document for tax filing. It is important to review the W-2 form carefully to ensure that it is accurate. If there are any errors on the W-2 form, it could result in a delayed refund or even an audit.

- Planning: Knowing the Robinhood W-2 release date allows taxpayers to plan ahead. They can set aside time to gather their tax documents and file their taxes. This can help to reduce stress and ensure that taxes are filed accurately and on time.

- Tax preparation: Some taxpayers may choose to use a tax preparation service. Knowing the Robinhood W-2 release date allows taxpayers to schedule an appointment with a tax preparer. This can help to ensure that taxes are filed accurately and on time.

Overall, the Robinhood W-2 release date is an important date for taxpayers who use Robinhood to invest. By knowing the release date, taxpayers can ensure that they have the information they need to file their taxes accurately and on time.

2. Importance

The W-2 form is a critical document for taxpayers. It is used to report wages and taxes for the previous year. The Robinhood W-2 release date is important because it provides taxpayers with the information they need to file their taxes accurately and on time.

- Filing taxes: The W-2 form is the primary document used to file taxes. It reports information such as wages, taxes withheld, and other income. Without the W-2 form, taxpayers would not be able to file their taxes accurately.

- Calculating refunds: The W-2 form is also used to calculate tax refunds. The amount of the refund is based on the information reported on the W-2 form. Knowing the Robinhood W-2 release date allows taxpayers to estimate their refund and plan for the future.

- Avoiding penalties: Filing taxes late can result in penalties and interest charges. The Robinhood W-2 release date provides taxpayers with ample time to gather the necessary information and file their taxes on time.

Overall, the Robinhood W-2 release date is important because it provides taxpayers with the information they need to file their taxes accurately and on time. By knowing the release date, taxpayers can avoid penalties and interest charges, and they can also estimate their refund and plan for the future.

3. Accuracy

The Robinhood W-2 release date is important because it provides taxpayers with the opportunity to review their W-2 forms and ensure that they are accurate. Inaccurate W-2 forms can lead to errors in tax filing, which can result in penalties and interest charges. By reviewing their W-2 forms carefully, taxpayers can avoid these errors and ensure that they receive the correct tax refund.

- Components of an accurate W-2 form: A W-2 form includes several key components, including the employee's name, address, Social Security number, wages, taxes withheld, and other income. It is important to review all of these components carefully to ensure that they are correct.

- Examples of W-2 form errors: Some common errors that can occur on W-2 forms include incorrect names, addresses, Social Security numbers, and wages. These errors can be caused by a variety of factors, such as human error or data entry errors. It is important to review your W-2 form carefully to identify any errors so that you can correct them before filing your taxes.

- Implications of inaccurate W-2 forms: Inaccurate W-2 forms can have a number of negative consequences, including:

- Delayed tax refunds

- Incorrect tax liability

- Penalties and interest charges

- Audits

By reviewing their W-2 forms carefully and ensuring that they are accurate, taxpayers can avoid these negative consequences and ensure that they receive the correct tax refund.

4. Filing

The Robinhood W-2 release date is significant because it determines when taxpayers will have access to the W-2 forms they need to file their taxes. Without a W-2 form, taxpayers cannot accurately report their income and withholdings, which could lead to errors and delays in processing their tax returns.

- Understanding the W-2 Form: The W-2 form is a critical document that reports an individual's wages, withheld income taxes, and other compensation paid by their employer during the tax year. It serves as the primary source of information for filing tax returns.

- Timely Filing: The Robinhood W-2 release date affects the timeline for filing taxes. Taxpayers typically have until April 15th to file their returns, and having the W-2 form in hand by the release date allows ample time to gather necessary documents, prepare the return, and submit it before the deadline.

- Accuracy and Verification: The W-2 form is crucial for ensuring the accuracy of tax returns. By having access to the W-2 form, taxpayers can verify the information reported by their employer, identify any discrepancies, and make necessary corrections before submitting their returns.

- Avoiding Penalties: Filing taxes late or with incorrect information can result in penalties and interest charges. The Robinhood W-2 release date provides taxpayers with sufficient time to file their taxes accurately and on time, minimizing the risk of facing penalties.

In summary, the Robinhood W-2 release date is closely tied to the tax filing process. By providing taxpayers with timely access to their W-2 forms, the release date enables them to meet filing deadlines, ensure accuracy, and avoid potential penalties.

5. Deadline

The deadline to file your taxes is April 15th. This is an important date to keep in mind, as filing your taxes late can result in penalties and interest charges. The Robinhood W-2 release date is important because it provides taxpayers with the information they need to file their taxes accurately and on time.

For most taxpayers, the Robinhood W-2 release date is in late January or early February. This gives taxpayers plenty of time to gather their tax documents and file their taxes before the April 15th deadline. However, it is important to note that the Robinhood W-2 release date may vary from year to year. For the most up-to-date information, it is best to check with Robinhood directly.

If you are a Robinhood user, it is important to be aware of the Robinhood W-2 release date. By knowing when your W-2 form will be available, you can plan ahead and ensure that you have the information you need to file your taxes accurately and on time.

6. Extensions

The Robinhood W-2 release date is important because it provides taxpayers with the information they need to file their taxes accurately and on time. However, there may be circumstances where taxpayers need more time to gather their tax documents or file their taxes. In these cases, taxpayers can request an extension to file their taxes.

- Filing an Extension: Taxpayers can request an extension to file their taxes by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. This form must be filed by the original tax deadline, which is typically April 15th. Filing an extension will give taxpayers an additional six months to file their taxes.

- Reasons for Filing an Extension: There are many reasons why taxpayers may need to file an extension. Some common reasons include:

- Missing tax documents

- Complex tax situation

- Personal or family emergencies

- Military deployment

- Implications of Filing an Extension: Filing an extension will give taxpayers more time to file their taxes, but it will not extend the deadline for paying taxes owed. Taxpayers who owe taxes must pay them by the original tax deadline, even if they have filed an extension.

- Penalties for Late Filing: Taxpayers who fail to file their taxes on time may be subject to penalties and interest charges. The penalty for late filing is 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%. Interest is also charged on the unpaid taxes.

The Robinhood W-2 release date is an important date for taxpayers who use Robinhood to invest. By knowing when their W-2 forms will be available, taxpayers can plan ahead and ensure that they have the information they need to file their taxes accurately and on time. If taxpayers need more time to file their taxes, they can request an extension by filing Form 4868. However, it is important to note that filing an extension will not extend the deadline for paying taxes owed.

7. Penalties

The Robinhood W-2 release date is important because it provides taxpayers with the information they need to file their taxes accurately and on time. Filing taxes late or filing an inaccurate return can result in penalties and interest charges.

The penalty for late filing is 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25%. Interest is also charged on the unpaid taxes.

In addition, taxpayers who file inaccurate returns may be subject to penalties. The penalty for filing an inaccurate return is 20% of the additional tax that is owed. Taxpayers may also be subject to penalties for fraud or negligence.

The Robinhood W-2 release date is an important date for taxpayers who use Robinhood to invest. By knowing when their W-2 forms will be available, taxpayers can plan ahead and ensure that they have the information they need to file their taxes accurately and on time. This can help taxpayers avoid penalties and interest charges.

FAQs on Robinhood W-2 Release Date

The Robinhood W-2 release date is an important date for taxpayers who use Robinhood to invest. Here are some frequently asked questions about the Robinhood W-2 release date:

Question 1: When is the Robinhood W-2 release date?

Answer: The Robinhood W-2 release date is typically in late January or early February.

Question 2: Why is the Robinhood W-2 release date important?

Answer: The Robinhood W-2 release date is important because it provides taxpayers with the information they need to file their taxes accurately and on time.

Question 3: What happens if I don't receive my Robinhood W-2 form by the release date?

Answer: If you do not receive your Robinhood W-2 form by the release date, you should contact Robinhood customer support.

Question 4: Can I file my taxes before I receive my Robinhood W-2 form?

Answer: No, you cannot file your taxes before you receive your Robinhood W-2 form. The W-2 form contains important information that you need to file your taxes accurately.

Question 5: What should I do if I have questions about my Robinhood W-2 form?

Answer: If you have questions about your Robinhood W-2 form, you should contact Robinhood customer support.

These are just a few of the frequently asked questions about the Robinhood W-2 release date. For more information, please visit the Robinhood website or contact customer support.

Key Takeaways:

- The Robinhood W-2 release date is typically in late January or early February.

- The Robinhood W-2 release date is important because it provides taxpayers with the information they need to file their taxes accurately and on time.

- If you do not receive your Robinhood W-2 form by the release date, you should contact Robinhood customer support.

- You cannot file your taxes before you receive your Robinhood W-2 form.

- If you have questions about your Robinhood W-2 form, you should contact Robinhood customer support.

Next Steps:

- Visit the Robinhood website for more information about the W-2 release date.

- Contact Robinhood customer support if you have any questions about your W-2 form.

Conclusion on Robinhood W-2 Release Date

The Robinhood W-2 release date is important for taxpayers who use Robinhood to invest. The W-2 form is used to report wages and taxes for the previous year. By knowing the Robinhood W-2 release date, taxpayers can ensure that they have the information they need to file their taxes accurately and on time.

In this article, we have explored the Robinhood W-2 release date in detail. We have discussed the timing of the release, the importance of the W-2 form, and the consequences of filing your taxes late or filing an inaccurate return. We have also provided answers to frequently asked questions about the Robinhood W-2 release date.

We hope that this article has been helpful. For more information about the Robinhood W-2 release date, please visit the Robinhood website or contact customer support.

- Jacob Elordi Pirates Of The Caribbean

- Sean Evans Height

- Jennifer Hudson Husband 2024

- Courtney Love And Kurt Cobain Daughter

- Rhea Ripley Controversy

Robinhood Launches 3 Cash Back Credit Card, And You Can Get It in

Robinhood to release its IPO filing next week report

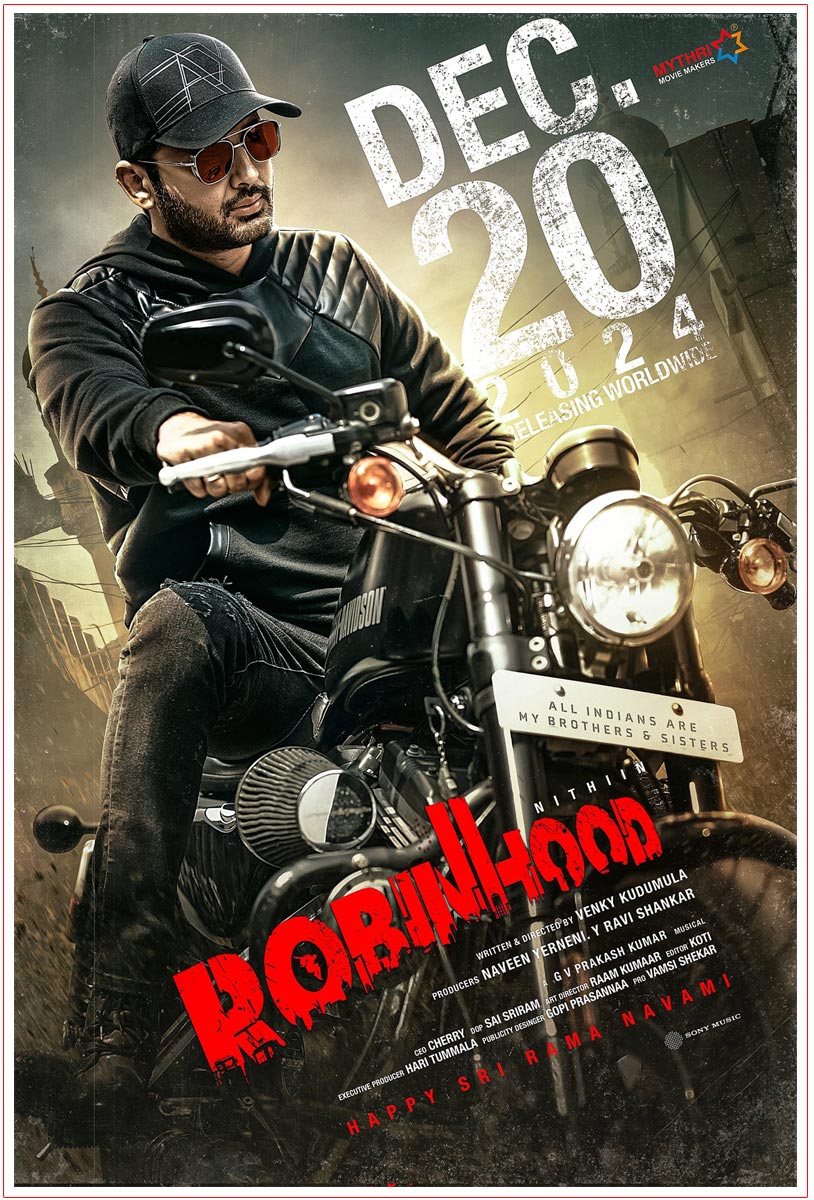

Nithiin Robinhood Finalises Release Date