Comprehensive PPP Loan Warrant List: A Guide For Businesses

What is a PPP Loan Warrant List?

A PPP loan warrant list is a document that contains the names of all businesses that have received a Paycheck Protection Program (PPP) loan and have outstanding warrants. The list is maintained by the Small Business Administration (SBA) and is updated regularly.

The PPP was a loan program created by the U.S. government in response to the COVID-19 pandemic. The program provided loans to small businesses to help them cover payroll and other expenses during the pandemic.

- Vin Diesel Gal Gadot

- Taylor Swifts Parents Reconcile

- Skeet Ulrich Hzastrs

- Wade Wilson Crime Scene Photos

- Simone Biles Pregnancy

Businesses that received PPP loans were required to use the money for specific purposes, such as paying wages, rent, and utilities. However, some businesses may have used the money for other purposes, such as paying down debt or making capital improvements.

The SBA has the authority to issue warrants to businesses that have outstanding PPP loans. A warrant is a legal document that gives the SBA the right to examine a business's records and interview its employees.

The PPP loan warrant list is a valuable resource for investigators who are looking into potential fraud or misuse of PPP funds.

- Jacob Elordi Pirates Of The Caribbean

- Barrett Carnahan Wife

- Dolph Lundgren Height

- Jung Hae In Kim Soo Hyun

- May 17th Zodiac

PPP Loan Warrant List

The PPP loan warrant list is a crucial document that provides insights into the distribution and potential misuse of funds allocated through the Paycheck Protection Program (PPP). Here are six key aspects to consider:

- Transparency: The list promotes transparency by making information about PPP loan recipients publicly available.

- Accountability: It holds businesses accountable for the proper use of PPP funds, deterring potential fraud.

- Investigation: The list assists investigators in identifying businesses that may have misused PPP loans.

- Enforcement: It supports enforcement actions by providing evidence of non-compliance with PPP guidelines.

- Data Analysis: The list enables data analysis to identify patterns and trends in PPP loan usage.

- Public Trust: It builds public trust by demonstrating the government's commitment to responsible lending practices.

These aspects highlight the importance of the PPP loan warrant list in ensuring the integrity of the PPP program, preventing misuse of public funds, and maintaining transparency in government lending.

1. Transparency

The connection between transparency and the PPP loan warrant list lies in the public's right to know how government funds are being distributed. The list promotes transparency by making information about PPP loan recipients publicly available, allowing for scrutiny and accountability.

Transparency is a crucial component of the PPP loan warrant list because it ensures that the public has access to information about how taxpayer money is being used. This transparency helps to prevent fraud and abuse, as businesses are aware that their use of PPP funds is subject to public scrutiny.

For example, the PPP loan warrant list has been used by journalists and investigators to identify businesses that may have misused PPP funds. In one case, a journalist used the list to identify a business that had received multiple PPP loans despite not being eligible. This information was then used to hold the business accountable and return the fraudulently obtained funds.

The transparency provided by the PPP loan warrant list is essential for maintaining public trust in government lending programs. By making information about PPP loan recipients publicly available, the government demonstrates its commitment to responsible lending practices and ensures that taxpayer money is being used for its intended purposes.

2. Accountability

The PPP loan warrant list plays a crucial role in holding businesses accountable for the proper use of PPP funds, deterring potential fraud through the following mechanisms:

- Transparency and Scrutiny: The list makes information about PPP loan recipients publicly available, allowing for scrutiny and oversight by the public and government agencies. This transparency deters businesses from misusing funds, as they are aware that their actions may be subject to public scrutiny.

- Audits and Investigations: The PPP loan warrant list assists auditors and investigators in identifying businesses that may have misused PPP funds. By providing a comprehensive list of PPP loan recipients, investigators can focus their efforts on businesses that exhibit red flags or have a history of non-compliance.

- Legal Consequences: Businesses that misuse PPP funds may face legal consequences, including criminal charges and civil penalties. The PPP loan warrant list serves as evidence of non-compliance, supporting enforcement actions taken by government agencies.

- Reputational Damage: Being included on the PPP loan warrant list can damage a business's reputation and make it difficult to obtain financing or contracts in the future. This reputational risk deters businesses from engaging in fraudulent activities.

In summary, the PPP loan warrant list promotes accountability by increasing transparency, facilitating audits and investigations, providing evidence for legal actions, and damaging the reputations of non-compliant businesses. These mechanisms collectively deter potential fraud and ensure that PPP funds are used for their intended purposes.

3. Investigation

The connection between the PPP loan warrant list and investigation lies in its role as a valuable resource for investigators seeking to identify businesses that may have misused PPP funds. The list provides a comprehensive database of PPP loan recipients, allowing investigators to focus their efforts on businesses that exhibit red flags or have a history of non-compliance.

- Red Flags: Investigators can use the PPP loan warrant list to identify businesses that have received multiple PPP loans, have received loans that are disproportionate to their size or industry, or have a history of financial distress. These red flags may indicate potential fraud or misuse of funds.

- Compliance History: The list also provides information on businesses that have been previously investigated or penalized for PPP loan violations. This information helps investigators prioritize their investigations and focus on businesses that are more likely to have engaged in fraudulent activities.

- Data Analysis: Investigators can use the PPP loan warrant list to conduct data analysis and identify patterns or trends in PPP loan usage. This analysis can help investigators identify businesses that are using PPP funds for unauthorized purposes or engaging in other fraudulent activities.

- Collaboration: The list facilitates collaboration between investigators at the federal, state, and local levels. By sharing information about PPP loan recipients, investigators can combine their resources and expertise to more effectively investigate potential fraud and misuse of funds.

In summary, the PPP loan warrant list is a powerful tool for investigators seeking to identify businesses that may have misused PPP loans. By providing a comprehensive database of PPP loan recipients and information on red flags, compliance history, and data analysis, the list assists investigators in prioritizing their investigations and more effectively combating fraud and abuse.

4. Enforcement

The PPP loan warrant list plays a critical role in supporting enforcement actions by providing evidence of non-compliance with PPP guidelines. This connection is crucial for ensuring that businesses that misuse PPP funds are held accountable and that the integrity of the program is maintained.

- Evidence for Investigations: The PPP loan warrant list serves as a valuable resource for investigators seeking to identify businesses that may have violated PPP guidelines. By providing a comprehensive database of PPP loan recipients, the list allows investigators to focus their efforts on businesses that exhibit red flags or have a history of non-compliance.

- Legal Proceedings: The PPP loan warrant list can be used as evidence in legal proceedings against businesses that have misused PPP funds. The list provides concrete evidence of non-compliance, supporting allegations of fraud or other violations of PPP guidelines.

- Civil and Criminal Penalties: The PPP loan warrant list can lead to civil and criminal penalties for businesses that have violated PPP guidelines. The list provides evidence that can be used to impose fines, sanctions, or even criminal charges against non-compliant businesses.

- Deterrence and Compliance: The existence of the PPP loan warrant list serves as a deterrent to businesses that may be considering misusing PPP funds. The list sends a clear message that non-compliance will be detected and punished, encouraging businesses to adhere to PPP guidelines.

In summary, the PPP loan warrant list is a powerful tool for enforcing compliance with PPP guidelines. By providing evidence of non-compliance, the list supports investigations, legal proceedings, and the imposition of penalties. It also serves as a deterrent to businesses that may be considering misusing PPP funds, ensuring the integrity and responsible use of the program.

5. Data Analysis

The PPP loan warrant list provides a valuable dataset for data analysis, enabling investigators and policymakers to identify patterns and trends in PPP loan usage. This connection is crucial for understanding how the PPP program was utilized, detecting potential fraud, and informing future lending practices.

- Identifying Red Flags: Data analysis of the PPP loan warrant list can help identify businesses that may have misused PPP funds. By examining loan amounts, industry distributions, and loan-to-revenue ratios, analysts can identify businesses that exhibit red flags or deviations from expected patterns.

- Trend Analysis: The list allows for trend analysis over time, providing insights into the evolution of PPP loan usage. Analysts can track changes in loan amounts, industry distribution, and loan approvals to identify emerging trends or shifts in lending practices.

- Geographic Analysis: Data analysis can also be used to examine geographic patterns in PPP loan usage. By mapping loan recipients by location, analysts can identify areas with high concentrations of loans or potential disparities in access to funding.

- Policy Evaluation: The PPP loan warrant list can be used to evaluate the effectiveness of PPP policies and lending criteria. By analyzing loan approvals and denials, researchers can assess whether the program met its intended goals and identify areas for improvement.

In summary, the PPP loan warrant list provides a rich dataset for data analysis, enabling investigators and policymakers to identify patterns and trends in PPP loan usage. This analysis is crucial for detecting potential fraud, understanding the program's impact, and informing future lending practices.

6. Public Trust

The PPP loan warrant list plays a crucial role in building public trust by demonstrating the government's commitment to responsible lending practices. Here are several key facets of this connection:

- Transparency and Accountability: The PPP loan warrant list promotes transparency by making information about PPP loan recipients publicly available. This accountability ensures that businesses are held responsible for the proper use of public funds, fostering public trust in government lending programs.

- Deterrence of Fraud: The list serves as a deterrent against potential fraud and misuse of PPP funds. By providing a comprehensive database of loan recipients, the list assists investigators in identifying businesses that may have engaged in non-compliant activities. This helps to protect the integrity of the program and maintain public trust.

- Legal Consequences: The PPP loan warrant list provides evidence of non-compliance, supporting legal actions against businesses that have misused PPP funds. This demonstrates the government's commitment to enforcing responsible lending practices and holding accountable those who violate the rules, further building public trust.

- Reputation Damage: Inclusion on the PPP loan warrant list can damage a business's reputation, making it difficult to obtain financing or contracts in the future. This reputational risk encourages businesses to adhere to responsible lending practices, contributing to the overall trustworthiness of government lending programs.

In summary, the PPP loan warrant list fosters public trust by promoting transparency, deterring fraud, supporting legal consequences, and damaging the reputations of non-compliant businesses. These facets collectively demonstrate the government's commitment to responsible lending practices, reinforcing public confidence in the integrity of government lending programs.

FAQs on PPP Loan Warrant List

The PPP loan warrant list is a valuable resource for investigators, policymakers, and the public. Here are answers to some frequently asked questions about the list:

Question 1: What is the purpose of the PPP loan warrant list? The PPP loan warrant list is a document that contains the names of all businesses that have received a Paycheck Protection Program (PPP) loan and have outstanding warrants. The list is maintained by the Small Business Administration (SBA) and is updated regularly.

Question 2: Why is the PPP loan warrant list important?

The PPP loan warrant list is important because it helps to ensure that businesses are using PPP funds for their intended purposes. The list also helps investigators identify businesses that may have misused PPP funds.

Question 3: How can I access the PPP loan warrant list?

The PPP loan warrant list is available on the SBA's website. You can search the list by business name, address, or loan amount.

Question 4: What should I do if I find my business on the PPP loan warrant list?

If you find your business on the PPP loan warrant list, you should contact the SBA immediately. The SBA will investigate your business to determine if you have misused PPP funds.

Question 5: What are the consequences of misusing PPP funds?

Businesses that misuse PPP funds may face civil and criminal penalties. These penalties can include fines, imprisonment, and being banned from receiving future government loans.

In summary, the PPP loan warrant list is an important tool for ensuring the integrity of the PPP program. The list helps investigators identify businesses that may have misused PPP funds and helps to protect taxpayers from fraud and abuse.

If you have any questions about the PPP loan warrant list, please contact the SBA.

Conclusion

The PPP loan warrant list is a critical tool for promoting transparency, accountability, and responsible lending practices in the Paycheck Protection Program (PPP). By making information about PPP loan recipients publicly available, the list helps to deter fraud, support investigations, and build public trust.

The PPP loan warrant list serves as a valuable resource for investigators seeking to identify businesses that may have misused PPP funds. It provides a comprehensive database of PPP loan recipients, allowing investigators to prioritize their efforts and focus on businesses that exhibit red flags or have a history of non-compliance.

The list also supports enforcement actions by providing evidence of non-compliance with PPP guidelines. It can be used in legal proceedings against businesses that have misused PPP funds, leading to civil and criminal penalties.

Data analysis of the PPP loan warrant list enables investigators and policymakers to identify patterns and trends in PPP loan usage. This analysis helps to detect potential fraud, understand the program's impact, and inform future lending practices.

The PPP loan warrant list is a testament to the government's commitment to responsible lending practices. It demonstrates transparency, accountability, and a willingness to hold businesses accountable for the proper use of public funds.

- Vin Diesel Gal Gadot

- Jeanne Clarkson

- David Muirs Wedding Pictures

- Drake Hogestyn

- Donald Glover Children

Bensalem Police's Warrant List Have You Seen These 14 People

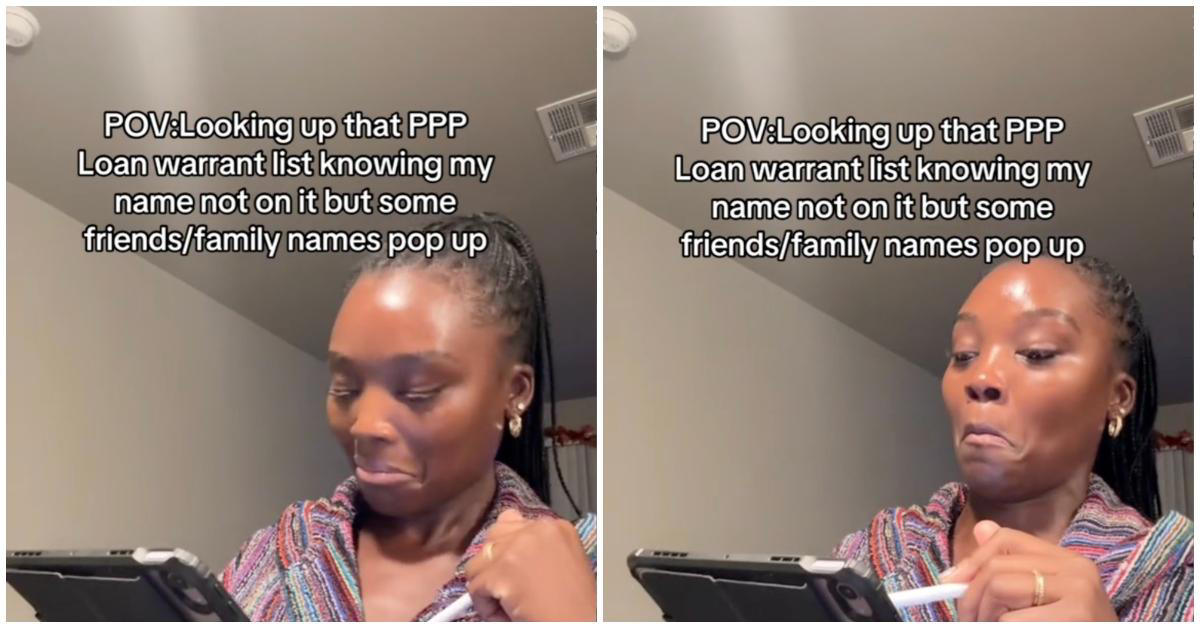

Rumors of a PPP Loan Arrest Warrant List Circulate on Social Media

Joliet police arrest 15 people for using fake business loans to bond